Mortgage Rates in 2025: Trends, Forecasts, and What Homebuyers Need to Know

As we navigate through 2025, mortgage rates continue to be a pivotal factor influencing the housing market. Understanding the current trends and forecasts can help prospective homebuyers, homeowners considering refinancing, and investors make informed decisions.

Current Mortgage Rate Landscape

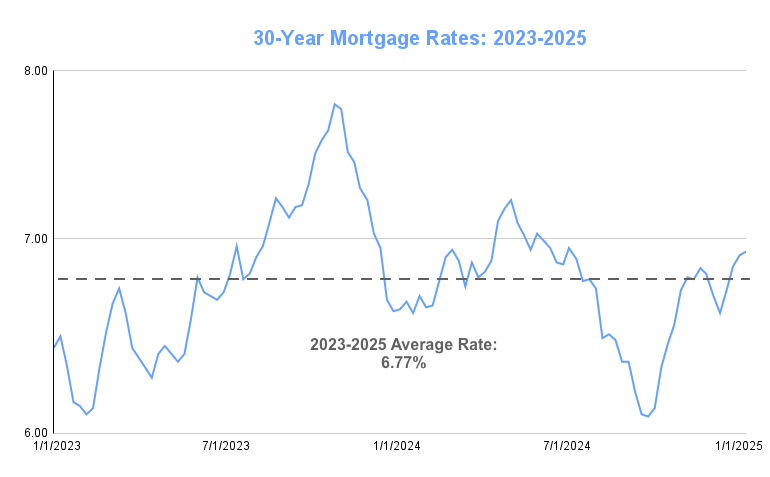

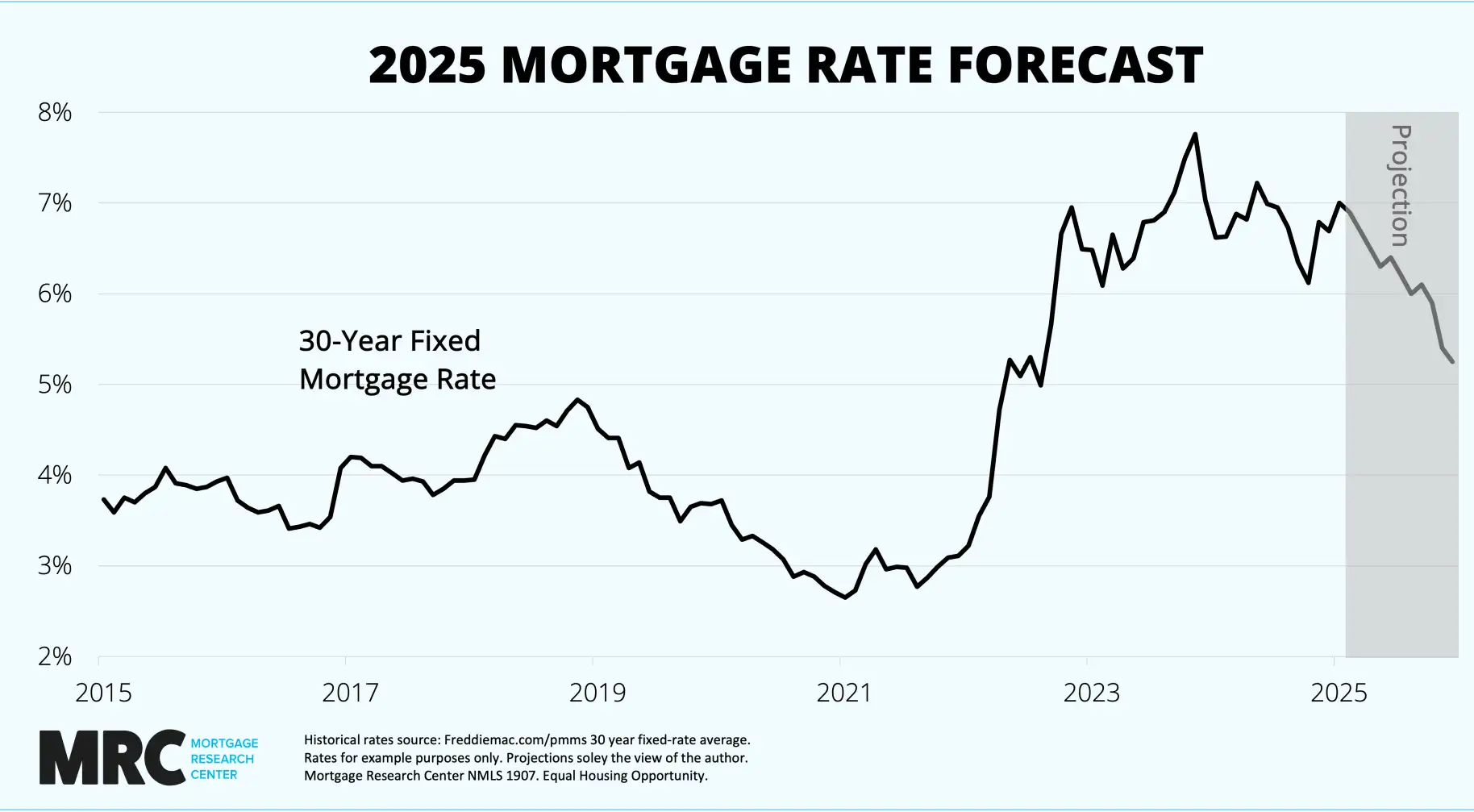

As of early 2025, the average 30-year fixed mortgage rate hovers around 6.8%. This marks a modest decrease from the peak rates observed in late 2023, which surpassed 7.7%. However, rates have remained relatively stable since mid-2024, fluctuating between 6% and 7% .Data Room TechnologyForbes

Expert Forecasts for 2025

Industry experts have varying predictions for mortgage rates in 2025:Axios

- Fannie Mae anticipates that 30-year fixed mortgage rates will average 6.8% throughout the year .deeilander.com+2Data Room Technology+2Forbes+2

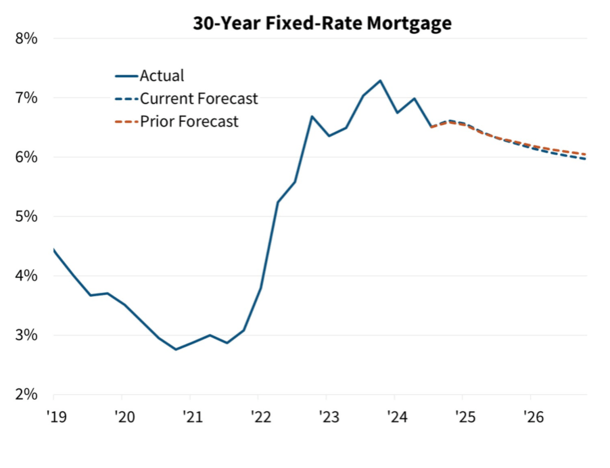

- Mortgage Bankers Association (MBA) forecasts rates to be slightly lower, averaging around 6.3% in 2025 .HousingWire

- LoanDepot projects a potential dip to the high 5% to low 6% range by late 2025, contingent on anticipated Federal Reserve rate cuts .Data Room Technology+1Axios+1

- Freddie Mac expects rates to remain above 6% into early 2025, with gradual easing over time, though volatility in economic data could lead to temporary rate spikes .Forbes+2Data Room Technology+2Axios+2

Factors Influencing Mortgage Rates

Several key elements are influencing the trajectory of mortgage rates in 2025:

- Federal Reserve Policies: The Federal Reserve’s decisions on interest rates play a significant role in shaping mortgage rates. While the Fed has signaled more rate reductions ahead, the full impact on mortgage rates may take time to materialize .Data Room Technology

- Inflation Trends: Persistent inflationary pressures can lead to higher mortgage rates as lenders adjust to maintain profitability. Conversely, a decline in inflation could pave the way for lower rates .

- Economic Indicators: Factors such as employment rates, GDP growth, and global economic conditions also contribute to the overall economic environment, influencing mortgage rate trends.

Implications for Homebuyers

For prospective homebuyers, understanding the current mortgage rate environment is crucial:

- Affordability Challenges: With rates still above 6%, monthly mortgage payments remain elevated, potentially limiting purchasing power for many buyers.Axios+1Data Room Technology+1

- Strategic Timing: While rates are expected to gradually decrease, it’s essential to assess personal financial situations and market conditions before making purchasing decisions.

- Exploring Alternatives: Buyers may consider adjustable-rate mortgages (ARMs), which often offer lower initial rates, or explore government-backed loan programs that may provide more favorable terms.

Conclusion

In 2025, mortgage rates are projected to remain above 6%, with gradual easing anticipated as the year progresses. While this provides some relief compared to previous highs, prospective homebuyers should remain vigilant, monitor economic indicators, and consult with financial advisors to make well-informed decisions in this evolving market.