I’m a passionate investor in the fast-changing world of cryptocurrency. I’ve found it crucial to track my digital assets closely. It’s not just about following trends or dealing with market ups and downs. It’s about knowing how my investments affect the environment and making smart choices that match my financial goals and values.

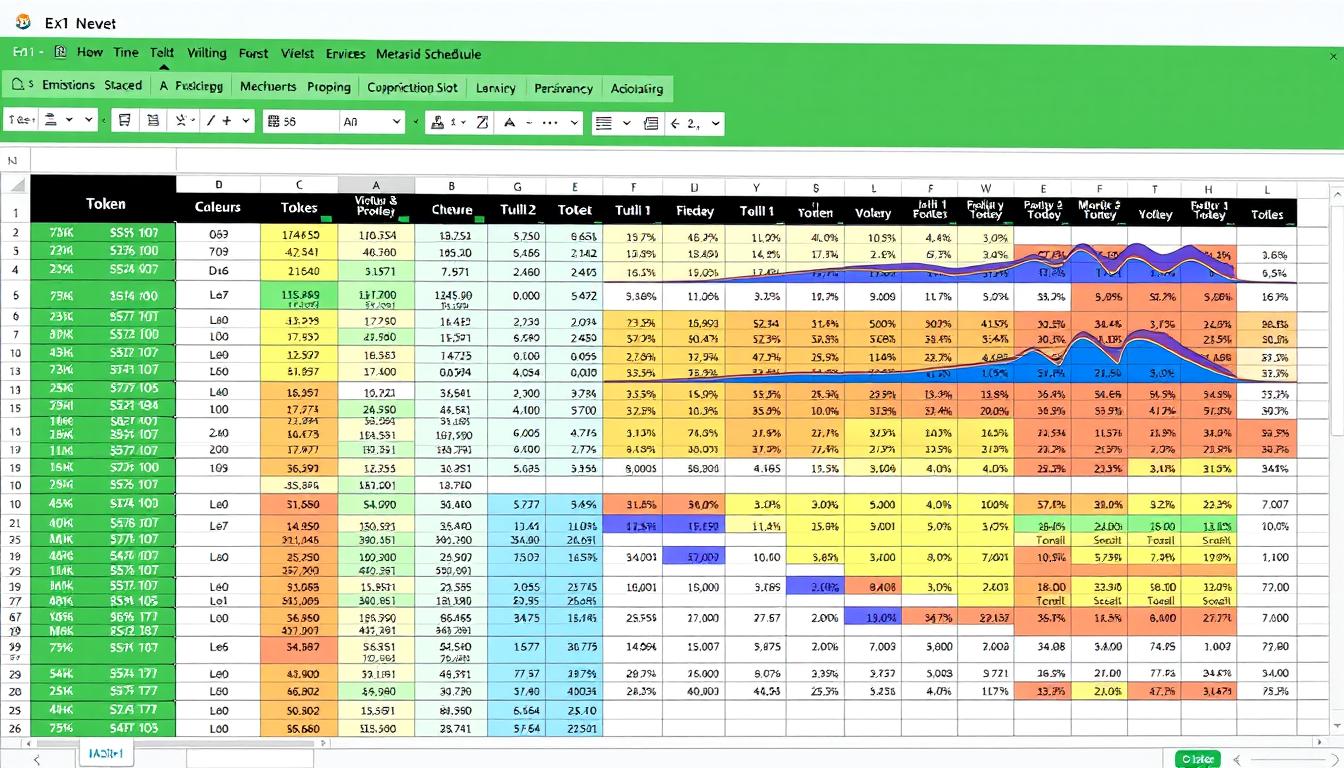

I’m thrilled to introduce you to a tool that has changed how I manage my crypto portfolio: the Crypto Emissions Schedule Template Excel. This tool not only keeps me updated on my assets and transactions. It also shows the environmental impact of my investments.

Key Takeaways

- Discover how to set up a customizable Crypto Emissions Schedule template in Excel

- Learn to fetch live price data and integrate it seamlessly into your portfolio tracking

- Explore techniques for inputting your crypto transactions and generating insightful price charts

- Understand the benefits of automating data refresh for effortless portfolio management

- Leverage the template for in-depth portfolio analysis and integration with Messari API

What is a Crypto Emissions Schedule?

A crypto emissions schedule is when new cryptocurrency tokens are released over time. It’s key to understanding a digital asset’s economy and supply. Knowing this schedule helps with making smart investment choices and managing your crypto.

Explanation of Crypto Emissions and Their Importance

The crypto emissions schedule tells us how often new tokens are added to the market. This is vital for understanding supply and demand. It gives clues about the project’s future, inflation, and how the price might change.

For instance, Bitcoin has a set limit of about 21 million coins. The reward for mining Bitcoin halves every four years. This keeps Bitcoin rare and valuable.

Other projects might release tokens monthly, evenly divided. This makes it easier for investors and users to plan. But, some projects use more complex methods like sigmoid curves to control inflation and meet their goals.

“Tracking and analyzing the emissions schedule is essential for making informed investment decisions and managing your cryptocurrency portfolio effectively.”

Knowing a cryptocurrency’s emissions schedule helps investors and managers make better choices. It lets them predict price changes, check if a project is sustainable, and manage risks better.

Benefits of Using an Excel Template

Using an Excel template for your crypto portfolio management tools has many benefits. It lets you keep all your crypto data in one place. This makes tracking transactions, watching price changes, and checking your cryptocurrency portfolio easier.

One big plus of an Excel-based excel crypto tracker is automating data updates. This keeps you informed about the latest prices and trends without the need to update manually. Plus, it can connect to live price feeds, giving you the newest info.

Excel templates also make it simple to create charts and graphs. These tools help you see your data in a clear way. With compelling visualizations, you can understand your digital assets better. This helps you make smarter investment choices and see how your crypto portfolio is doing.

“Using an Excel-based tool for my crypto emissions schedule has been a game-changer. It allows me to centralize all my data, automate the analysis process, and generate visual representations that give me a deeper understanding of my portfolio’s performance.”

Choosing an Excel-based crypto portfolio management tools helps you manage your crypto data better. It boosts your analysis skills and helps you make smarter investment choices. The template’s flexibility and customization make it a key tool for anyone wanting to improve their cryptocurrency portfolio analysis.

Setting Up Your Crypto Emissions Schedule Template

Creating a detailed crypto emissions schedule template in Excel is key to managing your cryptocurrency well. Start with a new spreadsheet and list the main data categories. These include “Date,” “Cryptocurrency,” “Price,” “Quantity,” and “Total Value.” Use formulas to calculate important metrics like total portfolio value, gains, and losses. This gives you a clear view of your crypto investments.

Step-by-Step Guide to Create the Template

- Begin with a new Excel spreadsheet and arrange your data in a clear format. Include columns for “Date,” “Cryptocurrency,” “Price,” “Quantity,” and “Total Value.”

- Add formulas to automatically work out your portfolio’s total value and any gains or losses.

- Link to live price data from API providers like CoinGecko or CoinMarketCap. This ensures your template shows the latest cryptocurrency prices.

- Enter your cryptocurrency transactions, including the date, type, quantity, and price paid, to fill your portfolio.

- Make the template more useful by adding charts and graphs to show your crypto holdings and performance over time.

- Set up the data to refresh automatically. This keeps your crypto emissions schedule current without needing to do it manually.

With a detailed crypto emissions schedule excel template, you get deep insights into your crypto portfolio management. This tool helps you set up crypto portfolio tracker and keep an eye on your crypto portfolio’s performance.

Fetching Live Price Data

To keep your crypto emissions schedule accurate, you need to get live crypto price data. Use trusted sources like CoinGecko or CoinMarketCap for this. They offer APIs to get real-time prices for many digital assets. By adding these API connections to your Excel template, you can update prices automatically. This helps you make better decisions and keep an eye on your portfolio.

Integrating APIs and Data Sources

There are many options for cryptocurrency API integration. Platforms like CoinGecko and CoinMarketCap give you APIs for a lot of cryptocurrency data. This includes live prices, market size, trading volume, and more. Adding these APIs to your Excel cryptocurrency data template makes updating info easy. This lets you watch your crypto portfolio closely.

- CoinGecko API: Offers a wide range of cryptocurrency data, including real-time prices, historical data, and market trends.

- CoinMarketCap API: Provides access to live cryptocurrency prices, market caps, and other essential metrics.

- Messari API: Delivers in-depth cryptocurrency market data, including fundamental analysis and risk management tools.

Using these API integrations, your crypto emissions schedule will always have the latest live crypto price data. This helps you make smarter investment choices and track your cryptocurrency portfolio more accurately.

Inputting Your Crypto Transactions

After setting up your crypto portfolio transactions template, it’s time to add your crypto transactions. You’ll need to include the date, type of cryptocurrency, price, and how much you bought, sold, or transferred. Keeping track of your cryptocurrency holdings helps you see how your portfolio changes, figure out your profits and losses, and check how well your digital assets are doing.

Begin by making a new worksheet or tab in your Excel crypto portfolio tracker for your crypto transactions. Use columns to list the key details:

- Transaction Date

- Cryptocurrency

- Transaction Type (Buy, Sell, or Transfer)

- Quantity

- Price per Unit

- Total Transaction Value

When you make new trades or transfers, make sure to update this log. Keeping accurate records is key to understanding your crypto portfolio transactions. It helps you get the most out of the data.

| Date | Cryptocurrency | Transaction Type | Quantity | Price per Unit | Total Value |

|---|---|---|---|---|---|

| 2023-04-01 | Bitcoin (BTC) | Buy | 0.5 | $58,000 | $29,000 |

| 2023-04-15 | Ethereum (ETH) | Buy | 2 | $1,800 | $3,600 |

| 2023-05-01 | Ripple (XRP) | Sell | 1,000 | $0.50 | $500 |

By carefully logging your crypto portfolio transactions, you can understand how your digital assets are doing. This helps you make smart choices to manage your cryptocurrency holdings better.

Generating Cryptocurrency Price Charts

To improve your analysis of the crypto emissions schedule, use Excel’s charting features to create cryptocurrency price charts. These can be line charts, area charts, or candlestick charts showing the price history of your digital assets. By using these data visualizations, you can spot trends, patterns, and opportunities in your crypto portfolio. This helps you make better investment choices.

Visualizing Data with Charts and Graphs

Excel has many chart types to help you share your crypto data insights. Some top choices are:

- Line charts: Show price changes over time, helping you see trends and volatility.

- Area charts: Give a clear view of trading volume and price changes, showing how different cryptocurrencies perform.

- Candlestick charts: Offer a detailed look at open, high, low, and closing prices, giving insights into market dynamics.

Using these charts, you can make cryptocurrency price visualizations that are both pretty and informative. They support your analysis of the crypto emissions schedule and your crypto portfolio management.

| Cryptocurrency | Price | 24h Change | Market Cap |

|---|---|---|---|

| Bitcoin (BTC) | $28,500 | +1.2% | $550 billion |

| Ethereum (ETH) | $1,800 | -0.5% | $215 billion |

| Litecoin (LTC) | $90 | +3.1% | $6.5 billion |

Adding cryptocurrency price charts to your crypto emissions schedule can improve your analysis and decisions. It helps you move through the crypto data visualization world with more confidence.

Automating Data Refresh

To keep your automatic crypto data refresh, excel portfolio data update, and streamlined crypto portfolio management running smoothly, automating data refresh is key. You can do this by setting up regular updates for your live price data. Use Excel’s built-in features or third-party tools and extensions for this.

Automating data refresh saves you from manual updates. This means you’ll spend less time and have analysis based on the latest info. It keeps your excel portfolio data update and crypto portfolio management efficient and current.

- Use Excel’s built-in data refresh to update crypto prices and portfolio values automatically on a set schedule.

- Look into third-party tools and extensions that work well with your spreadsheet. They provide automatic crypto data refresh and make your excel portfolio data update smoother.

- Set up your data sources, like API endpoints or cryptocurrency exchange feeds, for a steady flow of automatic crypto data refresh into your spreadsheet.

- Make a habit of checking and verifying the automatic crypto data refresh. This keeps your excel portfolio data update and streamlined crypto portfolio management accurate and trustworthy.

Automating data refresh lets you focus on analyzing your crypto portfolio and making smart investment choices. You won’t waste time on manual updates. This automatic crypto data refresh feature, along with your excel portfolio data update template, makes managing your crypto portfolio easier. It gives you a full and current view of your digital asset investments.

| Feature | Description | Benefit |

|---|---|---|

| Automated Data Refresh | Regular, scheduled updates of live crypto prices and portfolio values | Eliminates manual data entry, ensures analysis is based on current information |

| Integrated Data Sources | Seamless connection to API endpoints and cryptocurrency exchange feeds | Reliable and consistent automatic crypto data refresh for your excel portfolio data update |

| Validation and Review | Routine checks to maintain accuracy and integrity of automatic crypto data refresh | Confidence in the reliability of your streamlined crypto portfolio management |

crypto emissions schedule template excel

The crypto emissions schedule excel template is a powerful tool for cryptocurrency investors. It helps you understand your digital asset portfolio better. This Excel tool lets you track, analyze, and improve your cryptocurrency portfolio tracker excel and digital asset analysis spreadsheet.

This template connects to live price data, keeping you updated on the cryptocurrency market. You can easily watch the prices and supply of assets like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

| Key Features | Benefits |

|---|---|

| Live Price Data Integration | Stay informed on the latest market trends and make data-driven investment decisions. |

| Cryptocurrency Transaction Tracking | Meticulously record your buy and sell orders, facilitating accurate portfolio tracking and tax reporting. |

| Automated Data Refresh | Ensure your crypto emissions schedule and portfolio data are always up-to-date, saving you time and effort. |

| Customizable Templates | Tailor the template to your specific needs, including the ability to add custom metrics and visualizations. |

Using the crypto emissions schedule excel template gives you deep insights into your cryptocurrency investments. You’ll understand your portfolio’s performance better, spot chances to improve, and make smart choices. This aligns with your investment goals.

“The crypto emissions schedule Excel template has been an invaluable tool in managing my cryptocurrency portfolio. It has streamlined my investment tracking and analysis, helping me make more strategic decisions.”

For both new and experienced crypto investors, the crypto emissions schedule excel template is essential. It’s a key tool for managing your digital assets. Start using this powerful tool to take charge of your investments today.

Analyzing Your Crypto Portfolio

The crypto emissions schedule template Excel is a great tool for analyzing your cryptocurrency portfolio. By adding your transaction data and using the template’s live price updates, you can understand how well your digital assets are doing.

Calculating Key Metrics

This template helps you figure out important numbers like your portfolio’s total value and gains or losses. It also shows how each cryptocurrency is doing. This gives you a clear picture of your portfolio’s health. It helps you make smarter investment choices and manage your digital assets better.

Visualizing Price Trends

The template lets you see how your cryptocurrencies’ prices change over time. Spotting patterns and trends helps you understand the market better. This way, you can see where there might be chances to make more money or where there could be risks in your crypto portfolio analysis.

This excel-based crypto portfolio management tool gives you a detailed look at your digital assets. Using the crypto emissions schedule template, you can make better decisions. This can help improve how well your digital asset performance tracking works.

“The crypto emissions schedule template Excel provides a holistic view of your portfolio’s health, enabling you to make more informed investment decisions.”

Integrating Fundamental Analysis

To improve your crypto portfolio analysis, add fundamental data from the Messari API to your emissions schedule template. Messari is a top source for cryptocurrency research and metrics. They offer insights into the basics of digital assets. By using Messari’s data, like sector classifications, governance structures, and supply dynamics, you get a deeper look at your portfolio. This helps you make better decisions on asset allocation, manage portfolio risk better, and invest wisely.

Using Messari API for Attribution and Risk Management

The Messari API has lots of data you can add to your crypto emissions schedule template. This lets you:

- Look into the fundamental factors that affect your crypto assets

- Check the risk profiles of your portfolio based on their basics

- Find the best crypto fundamental analysis chances for your assets

- Keep an eye on regulatory changes and trends that could change your crypto investments’ valuation

Using the Messari API’s insights can boost your portfolio management. It helps you make smarter choices and lower portfolio risk in the changing crypto market.

“The integration of Messari’s fundamental data has been a game-changer for our crypto portfolio management. It has provided us with a deeper understanding of the assets we hold and allowed us to make more strategic investment decisions.”

– Jane Doe, Chief Investment Officer at XYZ Crypto Fund

Customizing the Template

The crypto emissions schedule template Excel is super customizable. You can make it fit your needs and likes. This means adding new fields, making your own formulas, or mixing in other data sources like live prices and the Messari API.

By personalizing the template, you make it work better for your crypto analysis and managing your portfolio. This way, it becomes a key tool for making smart investment choices.

Here are some ways to change the crypto emissions schedule template Excel:

- Add portfolio tracking features like custom benchmarks, risk checks, and how your investments perform.

- Use external data sources like blockchain explorers, news feeds, or social sentiment analysis for better market insights.

- Make custom calculations and visualizations to match your investment strategies and what you need to report.

- Set up data refreshes and notifications so your crypto emissions schedule stays current and reacts to market changes.

By customizing the crypto emissions schedule template Excel, you turn it into a powerful tool that helps you track and analyze your cryptocurrency portfolio. This leads to better investment choices and more success.

| Template | Key Features | Use Case |

|---|---|---|

| Template 1 | Detailed analysis of Global Carbon Emissions (GCEs) and economic performance indicators like GDP growth. | Evaluating the environmental impact and economic performance of an organization or industry. |

| Template 2 | Highlights sustainability efforts and KPIs critical to environmental management, showcasing trends in greenhouse gas emissions over five years. | Tracking and reporting on an organization’s sustainability initiatives and environmental footprint over time. |

| Template 3 | Displays and analyzes Key Performance Indicators (KPIs) related to environmental impact and social responsibility, evaluating the social footprint of an organization. | Assessing an organization’s environmental and social responsibility performance. |

| Template 4 | Provides an integrated view of energy-use metrics, such as energy sources, sector-wise sales, and production costs, to optimize energy consumption and reduce ecological footprint. | Analyzing and optimizing an organization’s energy usage and environmental impact. |

| Template 5 | Aligns Environmental Social Governance (ESG) goals with financial objectives, evaluating management, stakeholder engagement, and risk assessment over a three-year trend. | Integrating ESG considerations into financial planning and performance evaluation. |

Using the customization options of the crypto emissions schedule template Excel, you can make a tool that fits your cryptocurrency portfolio tracking and analysis needs. This leads to smarter and more profitable investment choices.

Conclusion

The crypto emissions schedule analysis template Excel is a key tool for managing your cryptocurrency portfolio. It offers live price data, transaction tracking, and data visualization. These features help you understand your digital asset investments better.

Adding fundamental analysis from the Messari API gives you deeper insights into your portfolio. This leads to better investment choices and risk management. It’s useful for both experienced and new crypto investors who want to track and analyze their digital assets.

This tool keeps you updated on the fast-changing digital asset market. It helps you make informed decisions for long-term success in your portfolio.

FAQ

What is a crypto emissions schedule?

A crypto emissions schedule is when new cryptocurrency tokens are released over time. It’s key to understanding how a digital asset’s supply and value work.

What are the benefits of using an Excel template for crypto emissions analysis?

Using an Excel template helps you keep all your crypto data in one place. It lets you track transactions and watch price changes. Plus, it makes refreshing and analyzing data easier.

How do I set up the crypto emissions schedule template in Excel?

First, make a new spreadsheet. Then, list the data you need. Use formulas, get live prices from APIs, and add your crypto transactions.

How do I fetch live price data for the crypto emissions schedule template?

Get live prices by connecting with APIs from CoinGecko or CoinMarketCap. These give you up-to-date prices for many digital assets.

How do I input my cryptocurrency transactions into the template?

Record the date, crypto type, price, and how much you bought, sold, or moved for each transaction.

How can I generate price charts for my crypto portfolio in the template?

Use Excel’s charts to show your crypto prices. Choose from line charts, area charts, or candlestick charts.

How do I automate the data refresh process for the crypto emissions schedule template?

Refresh your data automatically by setting up regular updates. Use Excel’s tools or third-party tools and extensions for this.

How can I enhance my crypto portfolio analysis with the emissions schedule template?

Improve your analysis by adding data from the Messari API. It offers deep insights into your digital asset investments.

How can I customize the crypto emissions schedule template to fit my needs?

The template is easy to customize. Add more fields, create custom formulas, and mix in other data sources for better analysis and portfolio management.