Your cart is currently empty!

Tag: Credit score improvement

Boost Your Chances of Credit Card Approval

Today, credit card companies are getting pickier about who they approve. With over 40 million Americans out of work, they’re looking closely at credit scores and income. It’s important for applicants to make themselves stand out.

This guide will help you understand the credit card application process. You’ll learn about credit score needs, income checks, and what lenders look for. By improving your finances and knowing the credit card market, you can increase your chances of getting approved for the right card.

Key Takeaways

- Understanding the credit card application process and the key factors lenders consider is crucial for securing approval.

- Credit score requirements have become more stringent, with issuers prioritizing applicants with higher credit scores and stable incomes.

- Proactive steps to improve your financial profile, such as managing credit utilization and payment history, can significantly enhance your chances of approval.

- Exploring alternative credit card options, including secured cards, can be beneficial for those with poor or limited credit histories.

- Timing your application strategically and monitoring the credit card market can help you capitalize on favorable conditions and new card launches.

Understand the Credit Card Application Process

Getting a new credit card requires knowing the application process well. Credit card companies now pickier about who they lend to. They look at your credit score requirements and income verification closely.

Credit Score Requirements

Lenders want to see FICO scores of 690 or higher to approve your application. If your score is lower, you might face tougher rules or even get denied. Only 29% of those with excellent credit get denied, but 73% with poor credit do.

The credit scoring system, like FICO and VantageScore, is key in the approval process.

Income Verification

Credit card companies also check your income verification closely. You’ll often need to show things like pay stubs, tax returns, or bank statements. This proves you can handle credit card debt.

Those with unstable or low incomes might find it hard to get approved.

Knowing about these factors can help you prepare and boost your chances of getting approved. Keep your credit strong and verify your income to feel confident in the application process.

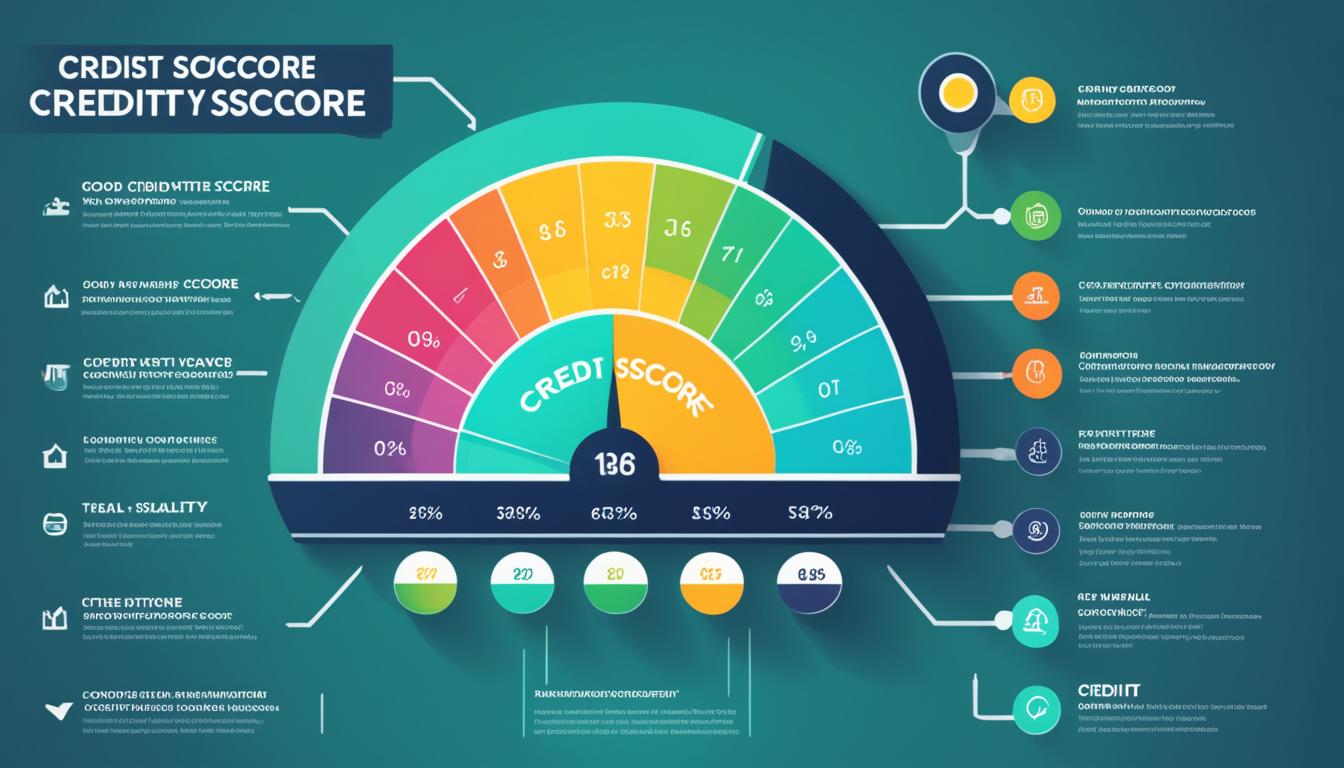

Credit Score Range FICO VantageScore Excellent 800-850 781-850 Very Good / Good 670-799 661-780 Fair 580-669 601-660 Poor 300-579 300-600 The credit card application process is complex, with each lender having its own rules. Knowing the key factors helps you prepare. It also lets you strengthen your credit and financial standing for better approval chances.

Improve Your Credit Score

Keeping a good credit score helps you get better loan terms and credit card approvals. Important factors that affect your score are payment history, credit utilization, and managing your credit history. By focusing on these, you can improve your creditworthiness.

Payment History Matters Most

Your payment history is key, making up to 35% of your credit score. It’s vital to pay all your bills on time, including credit cards and loans. Missing a payment can greatly lower your score, especially if you have good credit.

Manage Credit Utilization

Your credit utilization rate is also crucial, making up 30% of your FICO® Score. Try to keep your total balance below 30% of your credit limit. For better scores, aim for 10% or less.

By managing your credit well and paying on time, you show lenders you’re a reliable borrower. This can help you get credit cards and loans faster, even with a less-than-perfect history.

“Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit.”

Consider Different Card Options

Today, looking into credit card options beyond those for excellent credit might be smart. Your credit score is key, but there are choices for those with fair or poor credit. Secured credit cards and those for building credit can help improve your score over time.

Secured credit cards have easier approval than regular cards. You need to pay a deposit that becomes your credit limit. Making payments on time helps raise your credit score, opening doors to better cards later.

For those with bad credit, some credit card options are easier to get. These cards might have higher fees or rates, but they can help you move towards better credit and terms later.

Choosing a credit card means looking at the annual fee, interest rate, and rewards program. Secured cards or those for poor credit might cost more upfront, but they can help build credit over time.

“Rebuilding credit takes time and patience, but the right credit card can be a valuable tool in your journey towards financial stability and better credit opportunities.”

Looking at the wide range of credit card options can help you find one that fits your credit and financial goals. This can aid in building credit and improving your financial health.

Apply for a Secured Credit Card

For people with not much or no credit, secured credit cards are a great choice. They need a refundable deposit that becomes your credit limit. This shows you can handle credit well, helping those with bad credit get access.

Benefits of Secured Cards

Secured credit cards have many benefits for building credit:

- They let people get credit who might not get it with regular cards.

- Using a secured card well, like paying on time, can boost your credit score.

- After showing you can handle credit, many issuers might give back your deposit and upgrade you to an unsecured card.

Top Secured Card Picks

Look at cards like the Discover it® Secured Credit Card and the Capital One Platinum Secured Credit Card. These cards have cash back, no annual fees, and can increase your credit line over time.

Card Security Deposit Rewards Annual Fee Customer Satisfaction Discover it® Secured Credit Card $200 – $2,500 2% cash back at gas stations and restaurants, 1% on all other purchases $0 4.4 out of 5 stars (14,066 reviews) Capital One Platinum Secured Credit Card $49 – $200 None $0 4.4 out of 5 stars (14,066 reviews) Getting a secured credit card is a smart way to build or improve your credit score. It gives you access to tools and resources for credit building. By knowing the benefits and best options, you can start on the path to credit building success.

Time Your Application Strategically

With the economy uncertain and many facing financial struggles, the timing of applying for a credit card is key. Experts suggest thinking about if you really need a new credit card now or if waiting might be better. This approach can help you avoid denials or less favorable terms, which could hurt your credit score.

Choosing the best time to apply for a credit card means keeping up with the changing credit market. Watch industry trends and news to see how economic conditions might affect lenders. Applying when the market is favorable can boost your chances of getting approved.

Also, pay attention to the rules of credit card issuers. For example, Chase has a “5/24 rule” that limits approvals if you’ve opened five or more new credit cards in two years. Knowing these rules can help you plan your applications better and avoid denials.

Issuer Credit Card Application Policies American Express Allows up to 5 credit cards and 10 charge cards per customer Chase Implements the 5/24 rule, restricting customers from earning another welcome bonus if they’ve earned one in the past 24-48 months Bank of America Enforces the 2/3/4 rule for credit card approvals: two new credit cards within 30 days, three within 12 months, and four within 24 months Barclays May not approve a new card if the applicant has had more than six credit card applications in the last 24 months, following the 6/24 rule Capital One Limits customers to having two personal credit cards at a time, with one personal and business card approval every six months Understanding the current credit market, keeping an eye on issuer rules, and timing your application right can greatly improve your chances of getting approved. This way, you can get the credit you need.

Monitor the Credit Card Market

The credit card market is always changing. Keeping up with the latest trends can really help you. By monitoring the credit card market, you can find opportunities that match your financial goals and credit score.

New Card Launches

Credit card companies are always coming out with new card launches. These new cards might have great rewards, better benefits, or low interest rates. By watching the market, you can find the perfect card for your spending and credit situation.

Changes to Existing Cards

Card companies also change their cards often. They might change the rewards, fees, or interest rates. Keeping an eye on these credit card trends lets you know when to apply for a new card or switch to a better one.

Key Credit Card Market Metrics 2023 2024 (Projected) Total Credit Card Purchases (in trillions) $11.5 $12.0 Average Credit Card APR 21.51% 21.00% Digital Advertising Spend (in billions) $3.93 $4.49 Ecommerce Retail Spending (in trillions) $1.10 $1.20 Buy Now, Pay Later Spending (in billions) $72.00 $80.77 By monitoring the credit card market and keeping up with new card launches and changes to existing cards, you can make smarter choices. This helps you find the best credit card for your financial needs.

credit card approval

Getting a credit card approved can be tough, especially with today’s economy. Lenders are now more careful when they lend money. It’s important to know what they look at when they decide if you get the card. Your credit score and proof of income are key parts of this process. They help figure out if you’ll get the card.

Your credit score is a big deal in getting a credit card. It shows if you’re good with money and if you’re a risk to lenders. Having a score over 700 helps a lot. Also, keeping your credit utilization ratio under 30% shows you’re good with credit.

Lenders also look at your income verification. They want to see where your money comes from, like your job or other income. A lower debt-to-income (DTI) ratio is good too. It means you can handle more credit.

Approval Factor Importance Tips Credit Score High Maintain a score above 700 for better approval chances. Credit Utilization High Keep your credit utilization ratio below 30%. Income Verification Moderate Provide documentation of your regular sources of income. Debt-to-Income Ratio Moderate Maintain a low DTI ratio to demonstrate your ability to manage additional credit. Knowing these credit card approval factors and working on them can really help you get the card you want. The process isn’t the same for everyone. It’s important to keep up with changes to make smart choices.

Prepare for Additional Documentation

Credit card companies are getting stricter with their rules. They often ask for extra documents to check your income and identity. This is key to show you can handle credit well.

Proof of Income Sources

Applicants must prove their income, like with pay stubs, tax returns, or bank statements. Using The Work Number, an online service, can also help. This shows you’re financially stable, which helps get your credit card approved.

Identity Verification

Credit card companies want to make sure you’re who you say you are. They might ask for a government ID, social security number, or utility bills. Having these documents ready can speed up the process and prove you’re legitimate.

Being ready with these documents can boost your chances of credit card approval. Being proactive and detailed can really help you succeed in applying for a credit card.

“Providing accurate and comprehensive documentation can give credit card issuers the confidence they need to approve your application.”

Enroll in a Free Credit Monitoring Service

Keeping your credit in good shape is key when you’re looking to get a credit card. Luckily, many credit card companies offer free credit monitoring services. These services let you keep an eye on your credit score and any changes to your credit report. For example, Experian Credit Monitoring helps you track your score, alerts you to changes in your report, and gives you tips to improve your credit health.

Checking your credit regularly is a big part of the credit card application process. By doing so, you can spot and fix any mistakes or odd activity fast. This helps keep your credit history accurate and can even raise your credit score over time.

Free credit monitoring services like Credit Karma offer detailed credit reports and analysis tools. They give you a clear picture of what affects your credit score tracking and offer advice on credit health management. Checking your credit report often can reveal any negative marks or areas to work on, letting you take steps to improve your creditworthiness.

Signing up for a free credit monitoring service is an easy way to keep tabs on your credit. Using these tools helps you make better decisions and boosts your chances of getting credit card approval.

- Receive alerts about changes to your credit report

- Monitor your credit score and track its fluctuations

- Gain insights into improving your credit health management

- Identify and address potential errors or fraudulent activity

- Maintain an accurate credit history to boost your creditworthiness

Service Credit Bureaus Monitored Key Features Customer Ratings Experian Credit Monitoring Experian Credit score tracking, dark web monitoring, identity theft insurance 4.7/5 (based on 2,400+ reviews) Credit Karma Equifax, TransUnion Free credit reports, credit score tracking, credit monitoring alerts 4.5/5 (based on 564,000+ reviews) https://www.youtube.com/watch?v=_Lo3yWmyybE

“Enrolling in a free credit monitoring service is a simple and effective way to stay informed about your credit profile and increase your chances of credit card approval.”

Open a Checking Account

Opening a checking account is a key step in the credit card application process. It shows your financial activity to banks. This can prove your income and how well you handle money. Lenders look at this when deciding on credit card applications. So, having a checking account can boost your chances of getting a credit card.

Benefits for Approval

Having a checking account has many benefits for credit card applications:

- Income Verification – Your checking account shows your income and financial stability. This is key for getting a credit card.

- Credit History Demonstration – A positive balance and on-time payments in your checking account show you’re good with money. Lenders like to see this.

- Relationship Building – Opening a checking account at the same bank as your credit card application can strengthen your relationship with them. This might help your application.

Opening a checking account can really help you get the credit card you want.

Checking Account Details U.S. Bank Smartly® Checking U.S. Bank Safe Debit Minimum Opening Deposit $25 $25 Monthly Maintenance Fee $6.95 or $0 (waivable) $4.95 (not waivable) Criteria to Waive Fee $1,000+ monthly direct deposits, $1,500+ average balance, eligible personal U.S. Bank credit card, or Smart Rewards® tier None No Fee for Military, 24 & Under, 65 & Over Yes Yes By opening a checking account and managing your money well, you can up your chances of getting the credit card you want.

Understand Credit Card Qualifying Factors

When applying for a credit card, several important factors are looked at. Your credit score is a big part of this. It’s used by most lenders to decide if you qualify.

FICO scores range from 300 to 850. About 90% of lenders use these scores to make their decisions.

Credit Score Ranges

The average FICO credit score in the U.S. is 717 as of October 2023. Scores of 750 or higher mean you have excellent credit. You’ll get the best credit card offers and rates.

Those with scores under 580 are seen as having poor credit. They might get approved for secured cards or cards for those with limited credit.

Other Factors Considered

- Lenders check your income to see if you can pay back the credit card.

- They look at your credit utilization ratio. This is how much credit you’re using versus what you have. A ratio under 30% is best.

- A good payment history is key. Missing payments can hurt your score.

- Applying for many credit cards quickly can lead to hard inquiries. These can lower your score and hurt your chances of approval.

Knowing what lenders look at can help you get the credit card you need. It’s all about being prepared.

Credit Score Range Credit Rating Approval Likelihood 800-850 Excellent Very High 740-799 Very Good High 670-739 Good Moderate 580-669 Fair Low 500-579 Poor Very Low 300-499 Very Poor Extremely Low Conclusion

In the world of credit card approval, knowing how to apply and improve your finances is key. Focus on important factors like credit card approval, application strategies, and managing your money well. This can help you get the credit card that fits your needs and goals.

Lenders are getting pickier, so it’s good to stay up-to-date with credit card trends. Keep an eye on new cards, understand how credit checks work, and keep your credit score healthy. This way, you can confidently go through the application process and get the financial flexibility you want.

Getting a credit card is not just about the numbers. It’s also about showing you’re good with money and credit. Work on making your credit profile better overall. This makes you a better candidate for credit cards and opens up more financial opportunities. Use smart planning, careful credit management, and a proactive attitude to get the credit card that helps you financially.

FAQ

What are the credit score requirements for credit card approval?

Credit card companies usually want a FICO score of 690 or higher to approve applications. If your score is lower, you might face tougher requirements or get denied.

What documentation is required for income verification in the credit card application process?

Lenders now focus more on checking your income. They want to see things like pay stubs, tax returns, or bank statements. If your income is unstable, you might find it harder to get approved.

How important is payment history in determining my credit score?

Your payment history is key to your credit score, making up to 35% of it. It’s crucial to pay all your bills on time, including credit cards and loans, to keep your score good.

What are some credit card options for consumers with poor or limited credit histories?

For those with poor or limited credit, consider cards made for building credit. These include secured credit cards or cards for credit-building. They often have easier requirements and help improve your credit over time.

What are the benefits of using a secured credit card to build credit?

Secured credit cards are great for building or rebuilding credit. They require a deposit that becomes your credit limit. This shows you can handle credit well, making these cards easier to get for those with poor credit.

When is the best time to apply for a new credit card in the current economic climate?

Think carefully before applying for a new credit card now. Ask yourself if you really need one or if it’s better to wait. This can help avoid denials or less favorable terms that could hurt your credit further.

How can I stay informed about the latest credit card market developments?

Keep an eye on the credit card market to stay updated. This way, you can find opportunities that fit your financial situation and credit profile.

What are the key factors that credit card issuers consider when evaluating an application?

To boost your chances of getting approved, know what lenders look at. Your credit score, income proof, credit history, and overall creditworthiness are crucial.

What additional documentation may be required for income verification during the credit card application process?

Lenders now focus more on your income. They might ask for pay stubs, tax returns, bank statements, or info from The Work Number. This service offers employment and income details.

How can I monitor my credit score and credit report to improve my chances of credit card approval?

Keep an eye on your credit score and report. Many issuers offer free services like Chase Credit Journey. These let you track your score, get alerts on your report, and learn how to improve your credit.

How can opening a checking account benefit my credit card application?

A checking account shows your financial activity. It proves your income and how well you manage money, which lenders consider important when reviewing your credit card application.

What credit score ranges are typically required for different types of credit cards?

Knowing the credit score ranges lenders prefer is key. FICO scores of 690 or higher are usually better. If your score is lower, you might need cards for credit-building.

Build Your Credit with a Credit Builder Account

Did you know that over 85% of payments towards a credit builder account end up as savings? This financial tool helps you build or improve your credit and save money at the same time. It’s perfect for starting credit or rebuilding it after past issues.

A credit builder account is a mix of a loan and a savings account. It’s great for people wanting to increase their credit scores. By paying on time, you build a good payment history. This history is then reported to credit bureaus, which can greatly improve your credit score.

Key Takeaways

- Credit builder accounts help individuals establish or rebuild their credit history by reporting positive payment history to credit bureaus

- These accounts allow you to build savings while improving your credit score, with over 85% of payments coming back as savings

- Credit builder accounts typically do not require a credit check or hard pull, making them accessible to those with limited or poor credit history

- Choosing the right credit builder account based on factors like loan amount, repayment term, and fees is crucial to maximizing the benefits

- Making all payments on time and in full is essential to see the full credit-building potential of a credit builder account

What is a Credit Builder Account?

A credit builder account is a special financial tool. It combines a loan and a savings account. It helps people build or improve their credit by making regular payments on time.

When you open a credit builder account, a lender sets aside money in a savings account. This amount can be from $300 to $1,000. You then pay back this money over a set time, usually 6 to 24 months.

As you pay, the lender tells the credit bureaus about your payments. This can help increase your credit score. It’s a way for people with bad or no credit to show they can be trusted with money.

Key Features of Credit Builder Accounts

- Loan amounts typically range from $300 to $1,000

- Repayment terms span 6 to 24 months

- Interest rates can vary from around 5% to 16%, depending on the lender

- Administrative fees may range from $9 to $25

- Positive payment history is reported to credit bureaus

- Funds are held in a secured savings account until the loan is repaid

Lender APR Range Loan Amounts Loan Terms Digital Federal Credit Union 5% $300 – $1,000 6 – 24 months Self 16% $300 – $1,000 12 – 24 months 1st Financial Federal Credit Union 5% – 16% $300 – $1,000 12 – 24 months By paying on time, you can build or fix your credit history. This improves your credit score. It also opens doors to better financial options in the future.

How Does a Credit Builder Account Work?

A credit builder account is a special financial tool that helps you build or fix your credit history. When you start a credit builder account, a lender puts money aside in a savings account for you. You pay a fixed amount each month for a set time, usually 6 to 24 months. As you pay on time, the lender tells the big credit bureaus about your good payments. This can help improve your credit score.

This way, you show you’re good with money by paying on time. It’s great for people with little or no credit history. Or for those who have had credit problems before and want to fix their credit scores.

How Credit Builder Accounts Work

- The lender sets aside a specific amount of money in a secured savings account when you open the credit builder account.

- You make fixed monthly payments towards this account over a predetermined period, typically 6 to 24 months.

- As you make these on-time payments, the lender reports your positive payment history to the major credit bureaus.

- This can help boost your credit score by demonstrating responsible financial behavior.

Using a credit builder account, you can build your credit history. This can make it easier to get financial products and services later.

“Credit-builder loans are designed to assist those who are ‘credit invisible’ and individuals with a thin credit file in establishing credit history.”

To get the most from a credit builder account, pay on time and in full. By building your credit history with steady, smart money habits, you’re setting up a strong credit future. This can open doors to more opportunities later.

Benefits of Using a Credit Builder Account

Using a credit builder account has many benefits for those wanting to improve their credit. It helps you build or rebuild credit by making regular payments. This shows you’re managing money well, which can raise your credit score.

A credit builder account also helps you save money. After you finish the loan, you get back the money you put in, plus some interest. This way, you work on your credit and save at the same time, reaching two financial goals.

Another great thing about these accounts is they don’t check your credit to start. So, you can start building credit without hurting your score more. This is perfect for people with little or no credit history.

Maximizing the Benefits

To get the most from a credit builder account, pay on time and in full. Automatic payments can prevent missing due dates. Also, check your credit reports often to see how your credit is doing.

“By utilizing a credit builder account, individuals can enhance their creditworthiness and improve their overall financial future.”

A credit builder account is a great way to build credit, save money, and open better financial doors without needing a good credit history. Using this tool can help you reach your financial goals.

Establishing or Rebuilding Credit History

A credit builder account is great for showing you can handle money well by paying on time. It’s super helpful for people with little or no credit history. Or for those who have had credit issues and want to rebuild their credit.

When you pay on time, the lender tells the big credit agencies about it. This can really help increase your credit score improvement over time. It’s key for establishing credit and getting better deals on loans, credit cards, and mortgages.

Building Credit History with a Credit Builder Account

A credit builder account is made for people with not much or bad credit. By paying on time for a certain period, like 6 to 24 months, you show you’re good with money. This can slowly make your credit score go up.

Also, the account lets you build savings while rebuilding credit. After you finish paying off the loan, you get back all your money. You might even get some interest, which is a big plus.

“Building a strong credit history is crucial for accessing better financial opportunities and achieving long-term financial stability. A credit builder account can be a powerful tool in this journey.”

Using a credit builder account, people with little or no credit history or past credit challenges can start to establish credit. It’s a great way to improve your financial health.

Building Savings

A credit builder account does more than help with your credit. It also lets you save money at the same time. After you finish the loan and pay it off, you get the whole amount back in a savings account. You might even get some interest earned.

This way, you can save money and improve your credit score. Credit builder accounts are great for growing your finances. They don’t require a hard credit check and let you start with just $1 a month. Plus, they report to all three major credit bureaus, helping you build your credit and savings together.

“35% of the credit score is based on payment history, and Credit Builder accounts can help you demonstrate responsible financial behavior by making consistent, on-time payments.”

Making regular payments on a credit builder account boosts your credit score and grows your savings account balance. This makes credit builder accounts a smart choice for improving your finances.

When picking a credit builder account, look at the interest rates, fees, and how you’ll repay it. With the right one, you can manage your money better and reach your savings and credit goals.

No Credit Check or Hard Pull

A credit builder account is great because it doesn’t check your credit or pull a hard credit report. This is super helpful for people with bad or little credit history. It lets them start fixing their credit without making it worse.

Traditional credit products like credit cards and loans often need a hard credit check. This can lower your credit score. But, with a credit builder account, you skip this step. You can start building good credit without hurting your credit score.

Credit Card No Credit Check No Hard Pull Chime Secured Credit Builder Visa Credit Card Yes Yes Current Build Card Yes Yes Varo Believe Secured Credit Card Yes Yes Using a credit builder account helps you start building your credit without the worry of a credit check or hard pull. This lets you focus on paying on time and showing you’re financially responsible. These are important for improving your credit score over time.

Being able to build credit without a credit check or hard pull is a big deal for people with bad or little credit history. It gives them a chance to take charge of their finances. This can lead to better credit access, lower interest rates, and better financial health overall.

Choosing the Right credit builder Account

When picking a credit builder account, look at the loan amount, repayment term, interest rate, and fees. Lenders offer different terms, so compare them to find the best fit for your finances and goals.

Credit builder loans usually range from $300 to $1,000. They have repayment terms of 6 to 24 months. The annual percentage rate (APR) varies a lot, from 5% to 36%. Some credit unions even offer rates as low as 0%.

Check the fees of credit builder accounts, like application, admin, or late fees. Look at the total cost and features of different lenders to find the best one for your budget and goals.

Lender Loan Amount Repayment Term Interest Rate (APR) Fees Credit Karma $500 – $1,000 12 – 24 months 15.51% – 15.92% $9 – $15 monthly fee Credit Strong $500 – $1,000 12 – 24 months 15.51% – 15.73% $15 – $25 monthly fee Digital Federal Credit Union (DCU) $500 – $3,000 12 – 24 months 5.00% $0 – $5 monthly fee When choosing a credit builder account, think about the lender’s reputation, customer service, and extra features. Look for regular credit score updates and reporting to major credit bureaus. This way, you can pick the credit builder account that fits your financial goals and helps improve your credit history.

Tips for Maximizing the Benefits of a Credit Builder Account

To get the most out of a credit builder account, focus on a few key strategies. First, always pay on time and in full. Late or missed payments can hurt your credit score, which goes against the account’s purpose.

Setting up automatic payments helps you never miss a due date. This keeps you on track with building your credit. Also, check your credit reports often to see how your credit is doing and fix any mistakes.

Key Tips for Maximizing a Credit Builder Account

- Make all payments on time and in full to establish a positive payment history

- Set up automatic payments to avoid missed deadlines

- Monitor your credit reports regularly to identify and address any errors or discrepancies

- Maintain a credit utilization rate below 30% to positively impact your credit score

- Consider using a secured credit card in conjunction with your credit builder account to further improve your credit profile

By using these strategies, you can make the most of a credit builder account. This helps you build or rebuild your credit history. It also opens doors to better financial products and opportunities later on.

“Using a credit builder account, Sarah increased her credit score by over 100 points within a year, demonstrating the powerful impact of responsible credit management.”

Metric Importance Payment History 35% of credit score Credit Utilization 30% of credit score Credit Age 15% of credit score Credit Mix 10% of credit score New Credit 10% of credit score By focusing on these key factors, you can improve your credit profile with a credit builder account. This opens doors to better financial opportunities in the future.

Conclusion

A credit builder account is a great way to improve your credit and save money. By paying on time, you show you’re good with money. This can make your credit score better over time. Plus, you save money, which helps with your financial health.

Looking to start or fix your credit? A credit builder account can help. Look at different options to find the best one for you. This way, you can work on your credit and save money at the same time.

To do well with a credit builder account, always pay on time and check your credit reports often. Use the savings part to grow your money. With careful planning and discipline, a credit builder account can be a big help in reaching your financial goals.

FAQ

What is a credit builder account?

A credit builder account is a special financial tool. It combines a loan and a savings account. It helps people build or improve their credit by making regular payments.

How does a credit builder account work?

When you open a credit builder account, the lender puts money aside in a savings account for you. You pay a fixed amount each month for a set time, usually 6 to 24 months. As you pay, the lender reports your payments to credit bureaus, helping your credit score.

What are the benefits of using a credit builder account?

Using a credit builder account has many benefits. It helps you start or improve your credit, build savings, and doesn’t require a credit check to open.

How can a credit builder account help establish or rebuild credit history?

A credit builder account lets you show you’re financially responsible by paying on time. This is great for those new to credit or rebuilding after credit issues.

How does a credit builder account help with building savings?

A credit builder account also helps you save money. After you finish the loan, you get the full deposit back, possibly with interest.

Does a credit builder account require a credit check or hard pull?

No, a credit builder account doesn’t need a credit check or hard pull. This is good news for those with poor or limited credit history.

What should I consider when choosing a credit builder account?

Look at the loan amount, repayment term, interest, and fees when picking a credit builder account. Different lenders offer different terms, so compare them to find the best fit for your finances.

How can I maximize the benefits of a credit builder account?

Pay all payments on time and in full to get the most from a credit builder account. Automatic payments can help you stay on track. Also, check your credit reports often to see how your credit is improving.

Boost Your Credit Score: Expert Tips and Tricks

Did you know over 62 million Americans have a “thin” credit file? This makes it hard to build a strong credit profile. Your credit score is key for getting good loan terms, credit card approvals, and even jobs. By knowing what affects your credit score and acting on it, you can open doors to better financial opportunities.

This guide offers expert advice and easy-to-follow tips to improve your credit score. It’s perfect whether you’re starting fresh or want to better your current credit history. You’ll get the knowledge and tools to reach your financial goals.

Key Takeaways

- Knowing what affects your credit score is key to improving it.

- Payment history is the biggest factor, making up 35% of your score.

- Keeping your credit use below 30% can greatly help your score.

- Having different credit types, like credit cards and loans, can boost your credit.

- Reducing hard inquiries from credit applications helps keep your score up.

Understanding Your Credit Score

Your credit score is a key measure of your financial health. It’s a three-digit number between 300 and 850 that shows how trustworthy you are to lenders. Knowing how your credit score works and what affects it is the first step to better financial health.

Credit bureaus like Equifax, Experian, and TransUnion gather info on people to create your credit score. The Fair Credit Reporting Act makes sure this info is correct. You can get one free credit report each year from these three major bureaus.

Your credit score is based on the FICO system. It looks at your payment history, how much you owe, how long you’ve had credit, new credit requests, and your credit mix. These factors help make your score higher or lower. A higher score means you’re seen as less risky by lenders.

FICO Score Range FICO Score Classification 800 to 850 Exceptional 740 to 799 Very Good 670 to 739 Good 580 to 669 Fair 300 to 579 Poor In the U.S., businesses use credit scores for loan, credit card, rental, and other decisions. A high credit score can lead to better financial options. But a low score can make getting credit hard or lead to bad terms.

Understanding your credit score and what affects it is key to managing your finances. By checking your credit report, fixing any mistakes, and improving your credit, you can aim for better financial health.

Payment History: The Key to a Healthy Score

Payment history is the most critical part of your credit score, making up 35% of your FICO score. It’s vital to pay your bills on time for your credit score to stay strong. Just one late payment can hurt your score a lot, affecting it for up to seven years. Making timely payments is key to a good credit score.

Importance of On-Time Payments

On-time payments are crucial for a solid credit history. Late payments can really hurt your score, possibly dropping it by up to 180 points. These issues can stay on your report for up to seven years, affecting your future finances. To keep a good score, you should:

- Pay all bills on or before the due date

- Address any past missed or late payments quickly

- Talk to creditors if you’re having trouble paying

- Look into debt management or consolidation to make payments easier

By focusing on timely payments and fixing any past issues, you can slowly improve your payment history. This will help increase your credit score over time.

“Payment history is the single most important factor in determining your credit score, accounting for 35% of your FICO score.”

Keeping up with on-time payments is the base of a good credit profile. By knowing how important payment history is and working on it, you can get a better credit score. This opens doors to more financial opportunities.

Manage Credit Utilization Effectively

Your credit utilization ratio is key, making up about 30% of your FICO score. It’s smart to keep this ratio under 30%. By managing your credit well, you can raise your score and better your financial health.

Strategies to Lower Credit Utilization

Paying down your credit card balances is a good move to lower your utilization. Paying off your cards throughout the month helps keep your balances low. Also, ask your card issuer for a credit limit increase to boost your available credit.

Spread your spending across several cards to avoid high utilization on one card. This is great if you have cards with different limits. Diversifying your spending keeps your overall utilization low.

Keep an eye on your credit utilization and make smart choices about your cards. Use credit score tracking apps and online credit simulators to help you. These tools offer insights and strategies to lower your utilization and improve your credit health.

“Keeping your credit utilization ratio below 30% is one of the best ways to maintain a healthy credit score and avoid potential financial pitfalls.”

The Importance of Credit Mix

Your credit mix, or the types of credit accounts you have, is key to your credit profile. It makes up 10% of your FICO® Score. This means it’s crucial for anyone wanting to boost their credit score. A diverse mix shows you can handle different credit types well.

A good credit mix includes revolving credit like credit cards and installment loans, such as mortgages and auto loans. This mix lowers the risk for lenders. It also helps improve your credit score over time.

Credit Type Examples Revolving Credit Credit Cards, Retail Store Cards, Gas Station Cards, HELOC (Home Equity Line of Credit) Installment Credit Mortgage, Auto Loan, Student Loan Remember, credit mix only counts for 10% of your FICO® Score. The other 90% comes from payment history, credit utilization, length of credit history, and new credit. Yet, having a diverse credit mix is still a smart move for building credit.

To better your credit mix, think about getting a new credit account. This could be a personal loan or a retail credit card. Just make sure it fits your financial goals and you can handle it well. The goal is to gradually build a mix of credit accounts, not to get too many at once.

“Diversifying your credit mix is seen as a long-term strategy that occurs naturally as you add new credit accounts to your file.”

credit score

Your credit score is key to getting loans and renting places. It’s a three-digit number from 300 to 850. It comes from your credit reports. These reports are kept by Experian, Equifax, and TransUnion, the big credit bureaus.

Having a score over 700 is good, and scores over 800 are great. The FICO and VantageScore systems are common. They look at different things and have their own scales. It’s important to check your credit reports often for mistakes.

Credit Score Range FICO® Score VantageScore Poor 300 – 579 300 – 600 Fair 580 – 669 601 – 660 Good 670 – 739 661 – 780 Very Good 740 – 799 781 – 850 Exceptional 800 – 850 781 – 850 Knowing what affects your credit score helps you manage your finances better. This includes how you pay bills, how much credit you use, and how long you’ve had credit. Taking steps to keep your score healthy can open up more financial doors for you.

“Your credit score shows how responsible you are with money. It helps you get loans, secure apartments, and more. By keeping an eye on your credit, you can open up many financial doors.”

Length of Credit History Matters

The length of your credit history is key to your credit score, making up 15-20% of it. The longer you manage credit accounts well, the better your score gets. This is what credit agencies and lenders say.

Preserving Older Accounts

Don’t close your oldest credit accounts even if you don’t use them. This can hurt your credit score by lowering the average age of your credit history. The age of your accounts and the oldest one are big factors in your score.

FICO says people with a top credit score of 850 have had their oldest accounts open for 30 years. For a good score of 700, this means over 100 points. And for an excellent score of 800, it’s 120 points. Even with a fair score of 620, it’s still 93 points.

Credit Score Average Age of Oldest Account Impact of 15% on Credit Score 850 (Perfect) 30 years 120 points 700 (Good) N/A 100 points 620 (Fair) N/A 93 points Keeping a long credit history and your oldest credit accounts helps your credit score a lot. It’s an important part of your financial plan.

Limit Hard Inquiries

When it comes to your credit score, it’s key to keep an eye on hard inquiries. Each time you apply for credit, like a credit card or loan, a hard inquiry is made on your credit report. These inquiries can lower your credit score by a few points. If you apply for many credits in a short time, the effect gets worse.

To lessen the hit from hard inquiries, apply for credit only when really needed. Use pre-qualification or pre-approval options when you can. These usually only do a soft inquiry, which doesn’t affect your credit score. This way, you can shop for credit without getting hit with many hard inquiries.

Hard inquiries drop off your credit report after two years. FICO® Scores look at hard inquiries from the last 12 months only. For student, auto, or home loans, FICO® Scores ignore inquiries from the last 30 days. If you apply for these loans in a 45-day span, it counts as one inquiry.

To lessen the effect of hard inquiries, don’t apply for many credit cards at once. FICO® Scores don’t combine these inquiries. Also, having good credit by paying bills on time and keeping your credit use low helps lessen the impact of hard inquiries on your credit score.

Knowing how to manage hard inquiries can keep your credit score healthy. This is key for getting good loan terms and credit approvals. Remember, managing your credit score well is crucial for your financial health.

Statistic Details Hard inquiries removal Hard inquiries are removed from credit reports after two years. FICO® Scores consideration FICO® Scores only consider hard inquiries from the past 12 months. FICO® Scores exclusion FICO® Scores exclude hard inquiries from student, auto, or home loan applications made in the previous 30 days. Multiple hard inquiries for loans Multiple hard inquiries within a 45-day period for student, auto, or mortgage loans are counted as a single inquiry in FICO® Scores. VantageScore consideration VantageScore credit scores consider hard inquiries for up to 24 months. VantageScore deduplication VantageScore credit scores deduplicate most hard inquiries within a 14-day window. Rate shopping deduplication Rate shopping within a 14-day period groups multiple hard inquiries as one inquiry in scoring models. Credit card applications Applying for credit cards at once is discouraged as FICO® Scores don’t deduplicate hard inquiries for these types of applications. Mitigating impact Building good credit through timely bill payments and low credit utilization ratios can mitigate the impact of occasional hard inquiries on credit scores. Lender consideration Most lenders consider six total inquiries on a credit report at one time to be too many for gaining approval for an additional credit card or loan. “Limiting hard inquiries is crucial for maintaining a healthy credit score and improving your overall financial well-being.”

Monitor and Dispute Inaccuracies

Checking your credit report often and fixing any mistakes can greatly improve your credit score. About 25% of Americans have errors on their credit reports, which can hurt their credit score. By reviewing your credit reports and fixing any wrong info, you make sure your credit score is correct.

Keeping Your Credit Report Clean

The big three credit bureaus – Experian, Equifax, and TransUnion – let you see your credit reports for free once a year. They also offer free weekly credit reports through AnnualCreditReport.com. Until 2026, you can get 6 free credit reports each year from Equifax. Checking your credit reports often helps you spot and fix credit report errors or credit report disputes fast.

If you find mistakes on your credit report, act fast. The credit bureaus have 30 days to fix errors for free. You can also ask them to tell anyone who got your credit report about any changes made in the last six months.

“Over 800,000 credit or consumer reporting complaints were received in less than two years, averaging more than 1,000 complaints daily.”

Sometimes, you might need to send several letters to fix credit report issues without getting a response. This can be tough, but you can add a statement of dispute to your credit file. This way, it will be in your credit reports for the future.

It’s a good idea to check your credit report once a year to find and fix errors. This helps make sure your credit score is a true picture of your finances.

Credit Repair Services: Proceed with Caution

While credit repair services may seem like a quick solution, be careful. A Consumer Reports study found 44 percent of people had errors on their credit reports. These errors could hurt your credit score. Things like late payments and bankruptcies can stay on your report for years.

Credit repair companies charge fees, from $20 to $195 to start, and then $70 to $150 a month. The Credit Repair Organizations Act (CROA) sets rules for these companies to protect consumers. But, not all services put the consumer first.

- Some credit repair businesses may not deliver on their promises, like fixing credit or getting loans or credit cards.

- Be careful with credit repair companies because not all are honest.

- Having a good credit score is key for big financial decisions, like buying a home.

- Credit interest rates can be high, from 19% to 28%, so a good credit score helps avoid high charges.

It’s better to fix your credit yourself than to rely on services. Many churches offer classes, like Dave Ramsey’s, that can help you understand and improve your credit.

Don’t think credit repair services are a quick fix. Take time to check your credit report, fix any errors, and work on improving your score. This way, you can make smart financial choices and get better interest rates. This leads to a more stable financial future.

Be Patient and Consistent

Improving your credit score takes time. It needs a careful, long-term plan focused on good credit habits. Improving your credit score is a slow process. It requires patience, discipline, and sticking to good financial habits.

Your credit score is affected by many things, like how well you pay your bills (35%), how much credit you use (30%), how long you’ve had credit (15%), the mix of your credit (10%), and new credit (10%). By always paying on time, keeping your credit card use low, and avoiding new credit checks, you can slowly get better over time.

There are no quick ways to fix your credit score. Trying to speed up the process, like opening many new accounts or using shady credit repair services, can actually hurt your score. The best approach is to focus building credit over the long term and stay committed to good habits.

“Achieving a good credit score is a marathon, not a sprint. It requires patience, discipline, and a commitment to responsible financial habits over time.”

Improving your credit score is a journey, not a goal. By sticking to good credit habits, you can slowly build a strong credit profile. This will help you in the long run.

Embrace the Long-Term Approach

Improving your credit score takes time and a long-term view. Here are some important tips:

- Always pay your bills on time. This is the biggest part of your credit score.

- Keep your credit card use low, aiming for less than 30% of your limit.

- Keep older credit accounts open to help your credit history, which is 15% of your score.

- Have a mix of credit types, like credit cards, loans, and more, to improve your score.

- Apply for new credit carefully to avoid too many “hard” checks that can lower your score.

By following these strategies, you can slowly improve your credit score. This will open up better financial opportunities for you in the future.

Conclusion

Having a strong credit score is key to good financial health. By knowing what affects your credit score and using the tips in this guide, you can improve your financial future. This means better loan terms, lower interest rates, and more credit options.

Be patient, stay consistent, and watch your credit management closely. Doing so will help you reach your financial goals.

Improving your financial health by managing your credit score well can lead to a brighter future. Learn about credit use, payment history, and credit mix to boost your credit score. With effort and smart choices, you can enjoy the perks of a high credit score and achieve your financial dreams.

Starting your journey to financial security means taking charge of your credit score. Use the advice and strategies from this guide to handle credit management well. With a strong credit score, you’re on your way to financial freedom and stability.

FAQ

What factors influence my credit score?

Your credit score depends on several key factors. These include your payment history, how much credit you use, the mix of your credit, how long you’ve had credit, and the number of hard inquiries.

How important is payment history for my credit score?

Payment history is very important, making up 35% of your FICO score. It’s key to pay on time to build a good credit history.

What is credit utilization and how can I improve it?

Credit utilization is how much of your available credit you’re using. It’s 30% of your FICO score. Try to keep this ratio under 30% by paying down credit card debt and maybe getting higher credit limits.

How does the length of my credit history affect my score?

The length of your credit history counts for 15% of your FICO score. Having older credit accounts is good because it shows you’ve managed credit well over time.

What is the impact of hard inquiries on my credit score?

Hard inquiries happen when you apply for new credit. They can lower your credit score by a few points. Try to apply for credit only when really needed to reduce the effect.

How can I monitor and dispute inaccuracies on my credit report?

Check your credit reports often and correct any mistakes. About 25% of Americans find errors on their reports. This can help boost your credit score.

Should I use a credit repair service to improve my credit score?

Credit repair services might seem appealing, but be careful. Some are not ethical or legal. It’s safer to manage your credit well over time yourself.

Boost Your Business: Essential Credit Tips for Success

Did you know that personal credit scores range from 300-850, but business credit scores are between 0-100? A good business credit score is 75 or higher, depending on the credit bureau. Building solid business credit takes time but opens doors to financial opportunities for your company.

These 10 essential credit tips can help you grow and succeed. They cover registering your business, getting an Employer Identification Number (EIN), and building relationships with vendors. This article will empower you to manage your company’s financial future.

Key Takeaways:

- Establish your business as a legal entity by registering and obtaining an EIN

- Open a separate business bank account to keep your personal and business finances distinct

- Build trade relationships with vendors and suppliers by paying bills on time

- Apply for a DUNS number to create a business credit profile with Dun & Bradstreet

- Utilize business credit cards and lines of credit that report to major credit bureaus

By following these business credit tips, you can set your company on the path to financial success. Stay tuned for the next section, where we’ll dive deeper into the steps to establish your business as a legal entity.

Establish Your Business as a Legal Entity

Starting your business on the right foot means making it a legal entity separate from you. This usually means registering it as a limited liability company (LLC) or corporation in your state. Getting an Employer Identification Number (EIN) from the IRS is also key.

Register Your Business and Obtain an Employer Identification Number (EIN)

After getting the right licenses and permits, open a business bank account for your company. This keeps your personal and business money separate. It also shows lenders and suppliers that your business is real and separate. Having a business bank account is crucial for building good business credit.

- Register your business as an LLC, corporation, or other legal entity in your state.

- Apply for an EIN from the IRS to identify your business with the government.

- Open a separate business checking account to manage your company’s finances.

Creating your business as a legal entity is the first step to building strong business credit. By doing this, you’re setting yourself up for better financing options and growth opportunities.

Build Trade Relationships with Vendors and Suppliers

Building strong vendor relationships, supplier relationships, and trade relationships is key for your business credit. Paying bills on time shows you’re financially responsible and reliable. This helps your business grow.

Small businesses often start by working with local vendors on net 30, net 60, or net 90 terms. This type of trade credit lets you order and pay later, improving your cash flow. Making timely payments builds a good credit history with vendors. This can lead to bank loans and more trade credit from suppliers.

Vendor Credit Terms Minimum Purchase Credit Bureaus Reported Uline Net 30 No minimum Experian Commercial, Dun & Bradstreet Quill Net 30 $100 Experian Commercial, Dun & Bradstreet Grainger Net 30 Business account setup required Dun & Bradstreet Summa Office Supplies Net 30 $75 Equifax Business, Experian Business Business T-Shirt Club Net 30 $69.99 annual membership, 12-piece minimum order N/A Networking with industry professionals can also boost your business credit. It helps you connect with customers, suppliers, and other businesses. These connections can lead to referrals, partnerships, and new sales.

Keeping good vendor relationships, supplier relationships, and trade relationships is key for your business credit. Paying bills on time and building these connections sets your company up for success.

Request Trade References and Maintain Positive Business Connections

As you [https://bykennethkeith.com/maximize-your-earning-potential-expert-tips/] build relationships with other businesses, you can ask them to be trade references for you. These references show your payment history and how reliable you are as a business partner. Keeping positive business relationships helps you get good trade references. This can lead to better credit lines with vendors.

Most business credit applications want three trade references. These are usually from creditors and suppliers in your industry. Companies and banks look at these references to make sure you can pay your debts on time. Small businesses do better with trade references if they pay well to the company that gives the reference, especially with net 30 terms.

Key Benefits of Positive Trade References Potential Consequences of Negative Trade References - Improved credit reports and scores

- Higher credit limits and better payment terms

- Increased borrowing power and lower interest rates

- Streamlined business operations and improved cash flow

- Damaged credit reports and scores

- Reduced credit access and higher borrowing costs

- Strained supplier relationships and delayed payments

- Increased risk of bad debt and cash flow issues

By focusing on trade references and positive business connections, you can make your company more creditworthy. This opens up opportunities for growth and success.

“Timely reporting of account receivables ensures faster payment and lessens the burden on credit management teams. Trade references are crucial in mitigating the risk of bad debt by providing insights into client reliability.”

Apply for a DUNS Number

Getting a DUNS number is key to building your business credit profile. A DUNS number, made by Dun & Bradstreet, links your company to a detailed profile. Lenders use this to check if you’re creditworthy.

Getting a DUNS number is free and easy through the Dun & Bradstreet website. It usually takes about two weeks. But it’s worth it, as it can lead to better loan terms, higher credit limits, and more growth chances for your business.

For small business owners, a strong DUNS number and business credit profile is crucial. Dun & Bradstreet says payment history is key to business credit scores. Building good trade relationships with vendors who report to credit agencies can really help.

Benefit Explanation Access to Government Contracts and Grants A DUNS number is often needed to bid on government contracts and apply for grants. This can bring in new money for your business. Improved Financing Options Lenders and suppliers look at your DUNS number and business credit profile to see if you’re creditworthy. This can lead to better loan terms and higher credit limits. Enhanced Vendor Relationships Vendors and suppliers might give you better payment terms if your DUNS number and credit history are strong. By focusing on setting and keeping an eye on your business, you’re setting your company up for success and growth. Invest in your DUNS number now, and see new opportunities come your way.

Use Accounts That Report to Credit Bureaus

Building a strong business credit profile is key for your company’s future success. Using accounts that report to major credit bureaus like Dun & Bradstreet and Experian is a smart move. These accounts can greatly improve your business credit score. This opens doors to better financing and vendor relationships.

Utilize Business Credit Cards and Lines of Credit

Getting a business credit card is a great way to start building your business credit. These cards offer a handy way to manage business expenses separately from personal ones. When you apply, make sure you have your company’s financial documents ready, like tax returns and bank statements.

Business lines of credit are also great for building credit. They let you get funds when you need them, and using them wisely can boost your credit score over time. Like with credit cards, you’ll need to provide financial documents to show you’re eligible.

Benefit Impact Reporting to credit bureaus Can increase business credit scores by up to 40% in the first 3 months¹ Establishing trade lines Average 32 point increase in credit scores at participating bureaus² Securing better terms Helps obtain more favorable financing and vendor agreements By using accounts that report to credit bureaus wisely, you’re building a solid business credit foundation. This can open up many opportunities for your company’s growth and success.

Establish Trade Lines with Vendors

Setting up trade lines with vendors and suppliers is key to building strong business credit. Trade lines are credit accounts you have with companies like your office supply distributor or local vendors. Keeping these accounts active shows you can handle credit well and improves your business credit score.

Take Advantage of Trade Credit and Payment Terms

Trade lines give you access to trade credit and flexible payment terms. Many vendors offer trade credit, letting you pay for goods or services later. These terms, like Net 15 or Net 30, help manage your cash better and improve your business’s cash flow.

Using and paying on time on these accounts also helps build your business credit. Industry data shows up to two actively reporting tradelines are provided by Nav Prime. It’s best to have two to three trade lines for the best credit building.

Statistic Value Small business owners who have built business credit history with Nav Prime 250,000+ Recommended number of trade lines for building business credit 2-3 accounts Minimum number of trade lines required for a PAYDEX score from Dun & Bradstreet 2 trade lines with at least 3 “credit experiences” Creating positive trade lines and paying on time is key to better business credit. This also opens doors to more financing options in the future.

Make Timely or Early Payments

Your payment history is key to your business credit, making up 35% of your score. Paying bills on time or early shows your company’s financial health. It also builds trust with lenders and creditors. Dun & Bradstreet gives perfect PAYDEX Scores to companies that pay early. The PAYDEX Score goes from 0 to 100, and a high score means a good payment history.

Having a strong payment history is vital for a good business credit. Here are tips for timely or early payments:

- Set up automatic payments or reminders to avoid being late.

- Negotiate with vendors for early payment discounts.

- Always pay bills on time or early to boost your score.

- Check your business credit reports often to make sure they’re correct.

By paying on time or early, you show your company is financially responsible. This can lead to better terms, higher credit limits, and easier financing access later.

“Establishing a positive payment history is one of the most effective ways to build and maintain a strong business credit profile.”

Your payment history is a big part of your business credit score. So, always pay on time or early to increase your creditworthiness.

Monitor and Maintain Your Business Credit

Keeping a strong business credit profile is key for getting loans, credit cards, and other financing. It’s important to check your credit reports often. This way, you can spot any mistakes that could hurt your credit score.

Regularly Review Credit Reports and Update Information

Your business and personal credit are different, so they don’t directly connect. But, if you’re a sole proprietor, your personal credit can affect your business’s credit score. Here’s how to keep an eye on your business credit monitoring:

- Get credit reports from big credit information companies like Dun & Bradstreet, Equifax, and Experian. Check them for any wrong info or mistakes.

- Make sure your business info is current, including contact details, payment history, and financial data. This keeps your credit reports correct.

- If you find mistakes, dispute them with the credit bureaus. This keeps your business credit accurate and fresh.

By keeping an eye on your business credit, you can spot and fix problems early. This helps you keep your financing options open and get better deals from vendors and suppliers.

Metric Value Percentage of businesses experiencing credit score decline in 3 months 33% Number of factors contributing to a Dun & Bradstreet credit rating 150 Percentage of commercial credit losses due to fraudulent activities 15-30% “Maintaining a good business credit score is crucial for qualifying for loans, credit cards, and other financing, with the potential to get lower interest rates on loans.”

Understand the Relationship Between Personal and Business Credit

Building a successful business means knowing how personal and business credit work together. These two credit types have different info but can affect each other, especially for small business owners.

Lenders look at both your personal and business credit scores when you apply for loans or credit. Keeping your credit in good shape in both areas can make your business look better to lenders. This can lead to better financing options.

Personal and business credit are not directly linked. Your business credit score is based on things like how well you pay, how much credit you use, and how long you’ve had credit. But, if you’re a sole proprietor, your personal credit can affect your business’s credit score.

To make the most of your personal and business credit, try these tips:

- Keep your personal and business money separate by using a business bank account and a business credit card.

- Start building your business credit by registering your company, getting a DUNS number, and using credit accounts that report to credit agencies.

- Pay all your business bills on time. This helps your personal credit too.

- Check your personal and business credit reports often to make sure everything is correct. Fix any mistakes or fraud quickly.

Understanding personal and business credit helps you manage them well. This supports your business’s long-term success and financial health.

“Maintaining good credit habits in both realms can help boost your business’s creditworthiness and open up better financing opportunities.”

business credit tips

Building a strong business credit profile takes time and effort. But, the benefits are huge. By using a strategic plan, you can get funding, keep your personal credit safe, and help your company grow. Let’s look at the key business credit tips to help you meet these goals.

The first step in the credit building process is to make your business a legal entity and get an Employer Identification Number (EIN). This step separates your personal and business money, creating a clear credit history for your business. Also, having a bank account just for your business makes your finances clearer.

- Build trade relationships with vendors and suppliers. They can be great references for your business credit.

- Get a DUNS number from Dun & Bradstreet, one of the big business credit bureaus, to start your business credit file.

- Use business credit cards and lines of credit. Pay on time to improve your credit history.

- Use trade credit from suppliers. This shows you handle money well.

Keeping your credit utilization ratio low is key for a good business credit score. Paying bills early or on time helps your PAYDEX score. This score is important for your payment history.

Check your business credit reports often and fix any mistakes. Knowing how your personal and business credit work together is also important. Your personal credit can affect your business financing, especially at the start.

By following these business credit tips and credit building strategies, you can build a strong credit profile. This will help you get better financing options, good supplier relationships, and success in the long run.

Leverage Business Credit for Financing and Growth

Building a strong business credit opens doors for your company. It lets you get loans and credit lines on good terms. This helps you invest in growing your business and succeeding in the long run. Keeping your business and personal credit separate protects your personal assets and credit score. It also makes your company look better to suppliers, vendors, and potential partners.

Having a mix of business credit types like vendor accounts, lines of credit, business credit cards, and loans gives you the flexibility you need. It helps you manage unexpected costs and take advantage of new opportunities. Using business credit can make it easier to get SBA loans with better rates and terms. It also helps you get higher credit limits, lower interest rates, and longer repayment periods on other loans.

Jay Cohen, CEO of Prolific Logistics, LLC, says, “Not understanding credit can lead to disaster in business.” Starting your business right, like registering with Dun & Bradstreet for a D-U-N-S number, sets you up for growth. Working with different banks and experts can also help you use business credit for financing and growth.

Credit Option Typical Terms Advantages Vendor Accounts Net 15-90 days Establishes trade relationships and reporting to credit bureaus Business Lines of Credit Revolving terms Provides flexible financing for cash flow and growth needs Business Credit Cards Revolving terms Can be used for day-to-day expenses and build business credit Business Loans Amortized terms Offers larger sums for major investments and expansion Using your business credit wisely can set your company up for long-term growth and success. Knowing the power of credit and getting advice from financial experts can guide you towards sustainable growth.

Protect Your Business with Comprehensive Insurance Coverage

As a small business owner, keeping your company safe is crucial. With over 33 million small businesses in the U.S. as of 2023, having good insurance is more important than ever. Sadly, 90% of business owners are unsure if they’re well-insured, and 29% don’t have any insurance.

Choosing the right insurance can protect your business from many risks. This includes things like liability claims and cyber attacks. If your business is small or home-based, you should look into these key insurance types:

- General Liability Insurance – This policy covers damage to others’ property, injuries, and other issues. The cost changes based on your industry and past claims.

- Professional Liability Insurance – Known as “errors and omissions” insurance, it protects against mistakes or negligence in your services.

- Cyber Liability Insurance – Small businesses often face cyber attacks. This insurance helps cover the costs of data breaches and other cyber issues.

- Workers’ Compensation Insurance – This is required by law for businesses with employees. It covers work-related injuries or illnesses.

Getting the right insurance might seem expensive, but it’s worth it for the peace of mind and protection it offers. Working with top companies like State Farm, Allstate, or Nationwide ensures your business is ready for anything unexpected and sets you up for success.

Insurance Type Key Coverage Typical Cost General Liability Third-party property damage, personal injury, advertising losses, reputational damage Varies by industry and claims history Professional Liability Financial losses due to errors or negligence in services provided Varies by industry and claims history Cyber Liability Data breaches, business interruption, legal issues Varies by size, industry, and risk factors Workers’ Compensation Benefits for work-related injuries or illnesses Varies by state regulations and payroll The cost of not having the right insurance can be much higher than paying premiums. Protect your company and your personal assets by getting comprehensive coverage now.

Utilize Exclusive Business Credit and Finance Resources

As a business owner, it’s key to keep your finances strong while growing your business. Luckily, there are special business credit resources and business finance resources to help you. Experian is a top name in credit building tools for businesses.

Experian has many services to help you manage your business credit. By checking your Experian credit report often, you can spot mistakes or fraud. This keeps your business credit history correct. It’s vital for a good credit score and getting loans.

Benefit Description Free Credit Report Experian gives you free access to your business credit report. This lets you know your financial status. Credit Monitoring It keeps an eye on your business credit profile. This way, you can quickly spot and fix any issues. Business Credit Building Experian’s credit building tools help you build, keep, and boost your business credit score over time. Using these business credit resources and business finance resources, you can protect your business and open new doors. Invest in your financial health now with Experian’s exclusive solutions.

“Building strong business credit is key for getting loans and growing sustainably. Experian gives you the tools and insights to manage your company’s finances well.”

Conclusion

Building business credit might seem hard, but the benefits are worth it. A strong business credit profile opens doors to better financing, protects your personal assets, and helps your company grow and succeed. Don’t miss out on this valuable opportunity. Start building your business credit now and secure your company’s future!

Business credit scores go from 0 to 100, showing how creditworthy your business is. This is different from personal credit scores, which range from 300 to 850. Keeping your credit use below 30% and working with vendors that report to credit agencies helps build a strong business credit history.

Lenders look at credit scores to see if you’re creditworthy. If your score is low, you might get higher interest rates or even be denied a loan. It’s important to keep a healthy debt-to-income ratio and watch your credit use closely.

Checking your credit reports from Dun & Bradstreet, Experian, and Equifax gives you insights into your business credit history. Lenders use these scores to decide on loans, interest rates, and terms. Keeping your personal and business credit separate protects your personal finances. Building a strong business credit portfolio with loans, credit cards, and lines of credit is key.

FAQ

What are the first steps in building business credit?

Start by making your business official with an LLC. Then, get an EIN and open a business bank account. These steps are key to building business credit.

How can I build relationships with vendors and suppliers to improve my business credit?

Working with vendors is a great way to start building your credit. Pay your bills on time and keep good relationships. This shows you’re reliable and financially responsible.

What is a DUNS number and how can it help improve my business credit?

Getting a DUNS number is good for your credit score. It’s a nine-digit ID that links your business to a Dun & Bradstreet profile. This lets lenders check your credit and financial history.

How can using accounts that report to credit bureaus help build my business credit?