Your cart is currently empty!

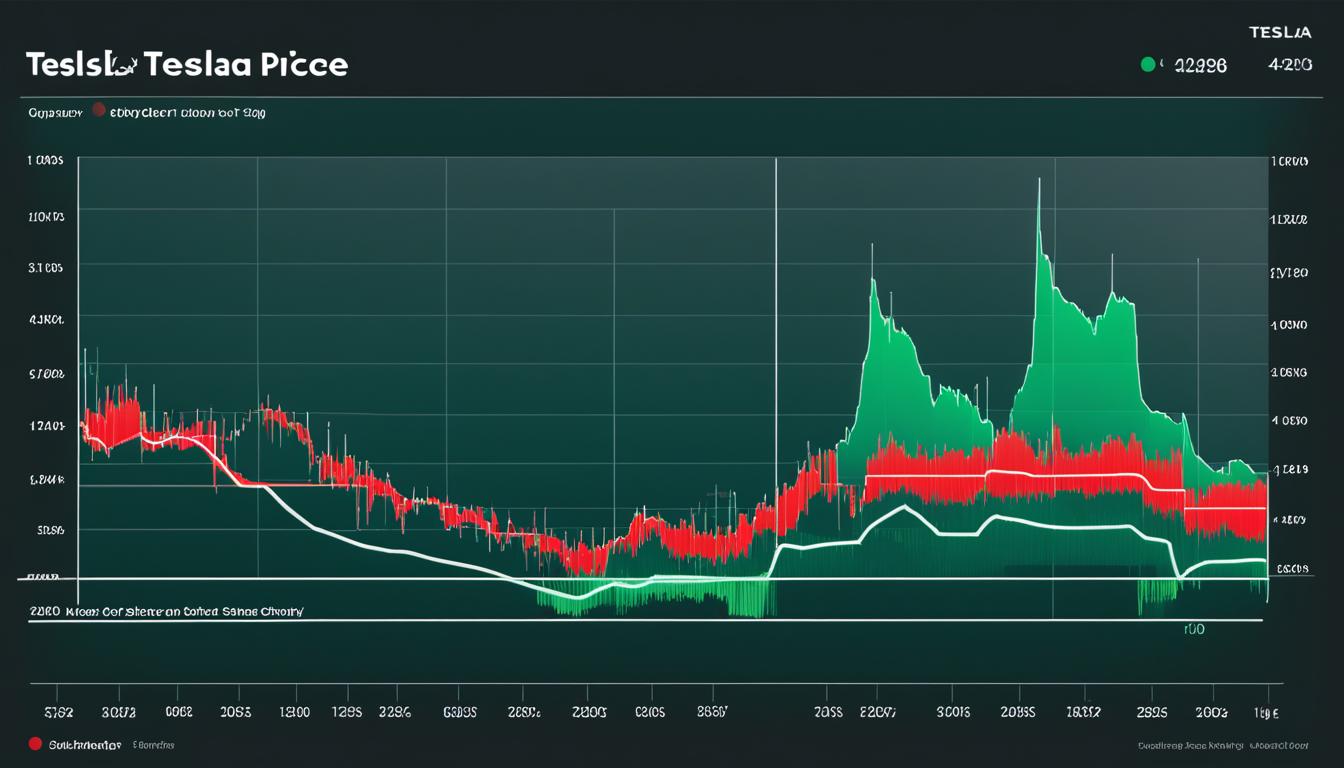

Tesla Share Price: Stock Analysis and Trends

In the world of electric vehicles, Tesla has caught the eye of investors and fans. But what’s behind the electric giant’s stock price? We’ll explore Tesla’s share price to see what drives its ups and downs. What factors have pushed Tesla’s stock up and down, and what does this say about its future?1

Tesla’s revenue jumped by 15.8% last year1, and earnings are expected to grow by 12.71% annually1. Yet, its stock price has been more up and down, dropping by -8.35% in a year but soaring by 1,439.42% over five years1. Over the past year, its price swings have been pretty steady at 9%1.

Today, Tesla’s market value is an enormous $802.15 billion, with earnings of $13.65 billion and revenue of $94.75 billion1. Its P/E ratio is 58.8x, and its P/S ratio is 8.5x1. This suggests the stock might be pricier than its rivals2.

Key Takeaways

- Tesla’s revenue has grown by 15.8% over the past year, and its earnings are forecasted to grow at a rate of 12.71% per year1.

- The company’s stock price has experienced significant volatility, with a 1-year change of -8.35% but a 5-year change of 1,439.42%1.

- Tesla’s market capitalization stands at $802.15 billion, with a P/E ratio of 58.8x and a P/S ratio of 8.5x12.

- The company’s share price volatility over the past year has been relatively stable at 9%1.

- Tesla’s stock has underperformed the broader market, with a 1-year return of -8.3% compared to the market’s 24% growth1.

Tesla’s Journey Beyond Electric Vehicles

Elon Musk, Tesla’s CEO, has big plans to go beyond electric cars3. He wants to make robots like the TARS robot from the movie Interstellar3. Tesla is also working on a robotaxi project, showing a big change in what they make.

Elon Musk’s Vision: From Cars to Robotics

Elon Musk sees Tesla doing more than just making electric cars3. He plans to make humanoid robots that can help with different tasks3. This move is part of Musk’s plan to make Tesla a leader in new technologies.

Tesla’s Diversification Strategies

Tesla wants to make more money, so it’s looking at new areas3. They’re making new products, like a robotaxi3. This shows Tesla wants to be a company that offers many different things, meeting more customer needs.

| Key Developments | Timeline |

|---|---|

| Tesla introduces the Model Y, which becomes the world’s best-selling vehicle in 2023 | 3 |

| Tesla’s energy storage deployments more than double in 2023 compared to 2022 | 3 |

| Tesla turns a profit every year since 2020 | 3 |

| Tesla’s stock price climbs from under $15 in 2019 to around $185 in mid-2024 | 3 |

Tesla is exploring new areas and taking advantage of new chances3. As they keep innovating, they’re changing the future of transportation and technology.

“We are building the future, not just making cars.”

– Elon Musk, Tesla CEO

Musk’s leadership has helped Tesla grow beyond just making cars3. With a focus on new technology, Tesla is set to change what we think is possible in transportation and robotics.

tesla share price Trends and Forecasts

Tesla’s stock is rated as a “Hold” by analysts. They have given 13 buy ratings, 14 hold ratings, and 8 sell ratings4. The average 12-month price target is $184.41, which is 26.68% lower than today’s price of $251.524. Analysts predict prices ranging from $310.00 to $2.004.

The highest price for Tesla’s stock was $252.37 on July 5, 2024. The lowest was $141.11 on April 23, 20245. The stock has seen a lot of ups and downs, with the highest trading volume at 243,869,700 shares on April 29, 2024, and the lowest at 85,315,300 shares on March 8, 20245.

Over the last 3 months, Tesla’s stock has gone up by 8.34%. Year-to-date, it’s up 12.14%, but down 5.77% over the past 6 months5. The current price is 3.52% higher than the predicted price of $242.676.

According to technical analysis, Tesla’s stock is in a state of fear, with a Fear & Greed Index of 396. The stock’s volatility is 10.32%, and 52% of trading days in the last 6 months ended with a price increase5.

Long-term forecasts suggest Tesla’s stock could reach $321.46 by 2025 and $1,096.27 by 20306. However, these predictions depend on many factors and should be viewed with caution.

| Metric | Value |

|---|---|

| Market Capitalization | $802.15 billion USD4 |

| Price to Earnings Ratio (TTM) | 62.964 |

| Basic Earnings per Share (TTM) | $4.29 USD4 |

| Net Income (FY) | $15.00 billion USD4 |

| Revenue (FY) | $96.77 billion USD4 |

| Number of Shares Float | 2.77 billion4 |

| Beta (1Y) | 2.144 |

| Number of Employees | 140.47 thousand4 |

| EBITDA | $12.27 billion USD4 |

| EBITDA Margin | 14.01%4 |

In summary, Tesla’s stock has seen a lot of ups and downs and growth over the past year. Analysts have given different price targets and forecasts. While the outlook for the long term looks good, investors should think about the risks and uncertainties before investing456.

Tesla’s Financial Performance

Tesla, a top electric vehicle (EV) maker, has been closely watched for its financial health7. Its stock price has seen ups and downs, now at $251.52, up 2.08%7. Yet, it’s 843% above its fair value7, hinting at possible overvaluation.

Revenue and Profit Analysis

Tesla’s finances show both good and bad signs. In the last year, its revenue hit $94.75 billion8. But, its revenue growth fell by 8.70% from the previous year8. On profits, Tesla’s margin is strong at 14.37%8. Yet, earnings growth dropped by 55.10% year-over-year8.

Key Financial Metrics and Ratios

Looking closer at Tesla’s numbers, we see a complex situation. Its EBITDA is $12.26 billion8, and net income is $13.65 billion8. But, its cash flow is negative at -$633.12 million8, which raises concerns about its future.

Tesla’s financial ratios also show a complex picture. The P/E ratio is a high 92.137, and the P/S ratio is 9.267. These suggest the stock is overvalued compared to others7.

In terms of cash flow, Tesla has a current ratio of 1.728, showing it can meet short-term debts easily. Its debt-to-equity ratio is a low 15.21%8, indicating careful financing.

Tesla’s financial performance is a mix of strong and weak points. Its future will depend on staying ahead in the EV market, innovating, and controlling costs789.

Analyst Ratings and Price Targets

According to the latest tesla analyst ratings, Tesla has a consensus rating of “Hold” based on 35 Wall Street analysts10. The average 12-month tesla stock price targets for Tesla’s stock is $184.41, with the highest target at $310.00 and the lowest at $2.0010. Analysts have given a mix of tesla investment recommendations, including 13 “Buy” ratings, 14 “Hold” ratings, and 8 “Sell” ratings10.

The tesla analyst ratings show a mixed view of the company. Tesla keeps a “Hold” consensus rating, but the stock price targets suggest a possible drop of -23.11% from now10. Yet, analysts have different views, with some seeing big gains and others expecting a big fall1011.

| Metric | Value |

|---|---|

| Consensus Rating | Hold |

| Consensus Price Target | $192.71 |

| High Forecast | $310.00 |

| Low Forecast | $85.00 |

| Potential Upside | 1.73% |

The tesla stock price targets from analysts show a wide range of possible outcomes for the company11. With a high forecast of $310.00 and a low forecast of $85.00, investors should think about the different scenarios and risks for Tesla’s future11.

Overall, the tesla analyst ratings and tesla stock price targets show Tesla is a topic of debate among analysts1011. Investors should watch Tesla’s financials, market trends, and regulatory changes to make smart investment choices1011.

“The range of price targets for Tesla shows the different views analysts have on its future. It’s key for investors to deeply research and grasp the factors behind these forecasts.”

Factors Influencing Tesla’s Share Price

Tesla, a leading electric vehicle (EV) maker, has faced many challenges that have affected its stock price. These challenges include demand and production issues, as well as growing competition in the EV market. Investors and analysts keep a close eye on Tesla’s performance.

Demand and Production Challenges

Tesla’s first quarter revenues fell by 9%, to $21.3 billion, and its net income dropped by 55% to $1.1 billion12. These declines are due to ongoing demand and production challenges. To adapt, Tesla has cut prices and adjusted production, affecting its profits and stock price12.

Losses in key markets like China and Europe have added to the demand issues12. This has led to a big drop in Tesla’s stock price, down over 40% in 2024 before the first quarter report12.

Competition in the EV Market

The electric vehicle market is changing fast, with more players joining the competition. This competition threatens Tesla’s lead and could affect its profits and stock price13.

Morningstar analyst Seth Goldstein thinks affordable vehicles will soon make up most of Tesla’s deliveries. He predicts Tesla will deliver about 5 million vehicles by 2030, a big jump from now12.

While Tesla led the EV industry, new rivals like Rivian and Lucid, plus traditional car makers entering the electric market, could challenge Tesla’s market share and pricing. This could impact its stock price13.

“Tesla’s financial performance, earnings, company guidance, car sales, and production are crucial factors influencing its stock price.”13

As the EV market grows more competitive, Tesla must keep its technological lead and adapt to changing consumer tastes. This will be key to its stock price future13.

Tesla’s Expansion Plans

Tesla, the top electric vehicle (EV) maker, is always looking to grow. They’re exploring new products and tech to go beyond cars14.

New Product Lines and Innovations

They’re working on a humanoid robot called “Optimus.” It’s meant to help people with different tasks. This robot takes inspiration from the TARS robot in “Interstellar”14.

They’re also creating a robotaxi, a self-driving car for rides. This move could bring in more money and make Tesla a top name in new mobility14.

| Tesla’s New Products and Innovations | Key Details |

|---|---|

| Optimus Humanoid Robot | Designed to assist humans with various tasks, inspired by the TARS robot from “Interstellar” |

| Tesla Robotaxi | Self-driving vehicle for autonomous transportation services |

Tesla’s new products show their drive to lead in tech and diversify their income. As they explore new areas, everyone will be watching their progress142.

“Tesla is not just a car company, but a technology and innovation company that happens to make cars.”

Elon Musk, Tesla’s CEO, said this. It highlights Tesla’s wide goals and dreams beyond just making cars14215.

Investing in Tesla: Opportunities and Risks

Investing in Tesla’s stock comes with both ups and downs. On the bright side, Tesla’s innovative products and strong growth potential are attractive. The company hit a trillion-dollar market cap in 2021, a feat few companies achieve16. Tesla led the electric vehicle market, selling 14.55% of all plug-in electric vehicles worldwide in the first half of 202116.

But, Tesla also faces challenges that could affect its stock and profits16. In 2018, it lost about $14,000 on each Model 3 sold, says Vertical Group analyst16. The company’s production issues and growing EV competition are also concerns16. It might need more Gigafactories to meet demand16.

Looking at finances, Tesla plans to spend $4.5 to $6 billion on capital each year, according to SEC filings16. Compared to Tesla, the Nissan Leaf starts at $27,400 and goes up to 226 miles, and the 2022 Chevrolet Bolt starts at $31,000 with a 259-mile range16.

When thinking about investing in Tesla, it’s important to weigh the pros and cons17. Tesla made almost 1.4 million EVs in 2022 and aims for 20 million annually by 203017. Yet, its profits jumped in 2022 but fell in 2023 due to rising costs and lower margins17.

17 Tesla made $2.3 billion in free cash flow in the first nine months of 2023, with a cash balance of $26 billion and only $4.4 billion in debt17. The company reinvested all earnings into growth and expansion, not paying dividends to shareholders as of 202317. Tesla’s stock price dropped about 30% by late 202318.

18 Ark Invest raised its Tesla stock target to $2,600 by 2029, seeing a big part of Tesla’s value in robotaxi business18. But, Wall Street’s 2024 estimates for Tesla earnings fell 37% since 2023, with a predicted $2.41 EPS in 2024, down 23% from 202318.

In summary, investing in Tesla means looking at its strengths, challenges, and financials. It’s key to research and analyze the tesla stock opportunities and tesla stock risks before investing161718.

Technical Analysis: Tesla Stock Charts

Tesla, a top electric vehicle maker, has caught the eye of investors and analysts. Its stock charts show a lively and unpredictable trading pattern. This offers key insights for those into technical analysis of Tesla stock.

Identifying Trends and Patterns

The stock’s charts highlight its high volatility with a beta of 2.1419. It hit its peak of $414.50 on November 4, 2021, and its lowest point of $1.00 on July 7, 201019. These charts reveal trends and patterns that investors can use to make better choices.

Recently, the stock has shown a strong buy trend, rated “Strong Buy”19. Over the last month, it also got a “Strong Buy” signal, boosting the positive outlook19. The stock’s oscillators and moving averages also point to a “Buy” rating, showing a good technical outlook19.

But, Tesla’s share price charts and trends data is not available right now20. Investors can use the Nasdaq+ Scorecard to analyze Tesla stock. This tool looks at market data and what’s important for Tesla’s performance in the Nasdaq 100 index20.

| Technical Indicator | Rating |

|---|---|

| Technical Rating | Strong Buy |

| 1-Week Technical Trend | Strong Buy |

| 1-Month Technical Signal | Strong Buy |

| Oscillators Overall | Buy |

| Moving Averages Overall | Strong Buy |

By looking at Tesla’s stock charts, investors can make smarter choices and possibly benefit from the company’s growth19. Tesla’s stock is very volatile, offering both chances and risks. This shows why careful research and risk management are key when thinking about investing in Tesla.

Tesla’s Impact on the Automotive Industry

Tesla has changed the game with its electric vehicles and cutting-edge tech. This has led to a big move towards electric and green mobility. It’s made traditional car makers speed up their EV plans21.

Tesla’s influence is wide-ranging. It made $21.3 billion in the first quarter, which was 9% less than last year21. Still, its impact on the market is huge22.

One big change Tesla made was making people want electric cars more22. Even though electric cars make up just 1% of the market, Tesla’s success has made other car makers invest in EV tech22.

Tesla also changed the game with its design, tech, and how it makes cars. It’s worth $56 billion, more than Ford and close to General Motors, even though it’s not as profitable22.

But, Tesla has faced hurdles too. Its sales were less than expected, and its shares dropped by 31% this year23. It also cut over 10% of its global staff, which was a big move21.

Still, Tesla’s effect on the car industry is huge. Its success has started a global move to electric and green cars. Traditional car makers are racing to keep up with Tesla’s tech22. As the EV market grows, Tesla’s role in shaking things up will only get bigger21.

“Tesla’s innovative electric vehicles and technology have had a significant impact on the automotive industry, pushing traditional automakers to accelerate their own EV development and adoption.”

Sustainability and Environmental Initiatives

Tesla puts a big focus on being green and caring for the planet. They use renewable energy in their own places and in the products they sell24. Thanks to Tesla, their customers cut down on 8.4 million metric tons of CO2 emissions in 202124. But, Tesla is last in reducing net zero emissions among 55 companies, says a 2022 report24.

Tesla’s Commitment to Renewable Energy

Tesla leads the way in making transportation and energy greener25. In 2015, they bought SolarCity for $2.6 billion, adding more to their green energy efforts25. They aim to use clean energy to power their own places too.

Their products like the Powerwall and Powerpack help people and businesses use more renewable energy25. Tesla raised $226 million in 2010, which helped them invest more in green tech25.

| Metric | Value |

|---|---|

| Market Cap | $802.1B USD9 |

| Price | $251.52 USD9 |

| Intrinsic Value under Base Case scenario | $56.42 USD9 |

| Overvaluation of Tesla Inc | 78%9 |

| Positive Operating Income | $7.4B USD9 |

| Positive Net Income | $13.7B USD9 |

| Revenue Growth over the past 12 months | 10%9 |

| Return on Invested Capital (ROIC) | 20%9 |

| Revenue growth forecast over the next 3 years | 13%9 |

Tesla is all in on being green and caring for the planet. They focus on renewable energy, storage, and green transport24. Even though most S&P 500 companies have ESG goals, Tesla’s got just 10.1% support for its sustainability plan24.

Tesla keeps pushing forward with its green mission, even when it gets tough24. Their stock dropped about 30% by early 2024, and their value fell by $620 billion since 202124. But, being green and using renewable energy is still key to Tesla’s identity and plans.

Tesla’s Brand and Marketing Strategies

Tesla has become a strong brand in the car industry thanks to Elon Musk’s leadership and innovative products26. It doesn’t spend much on traditional marketing. Instead, it uses smart strategies to promote itself26. The brand’s strong image and loyal customers have helped it grow.

Tesla connects directly with customers through social media and its own stores26. It offers three cars that can go from 0 to 60 mph in just 3 seconds26. Elon Musk’s social media presence helps a lot with marketing26. The company also focuses on supporting its customers after they buy a car.

Tesla’s marketing is all about being online, serving customers well, and letting customers help each other26. Its success comes from focusing on quality products and word-of-mouth26. The brand stands out by being real, consistent, and sometimes even controversial26.

Tesla doesn’t rely much on paid ads like other car companies27. It tried ads but then stopped using its marketing team28. Elon Musk said traditional ads are too boring28. Instead, Tesla builds a community and uses unique marketing tricks27.

On social media, Tesla shares interesting and helpful content to reach its audience27. Elon Musk uses his big social media following to promote Tesla28. The mention of a partnership with Purdue University for a digital marketing program shows Tesla’s drive for marketing innovation26.

Tesla’s focus on being real, consistent, and engaging with customers has made it successful26. The company changes its prices and Full Self-Driving software to stay appealing28. Tesla uses many channels to make its brand known and welcomes competition to spark new ideas26.

“Tesla’s marketing emphasizes brand awareness through multiple channels and welcomes competition to drive innovation.”

Even though Tesla is doing well, its stock fell over 45% after Elon Musk bought Twitter27. This shows how important it is to stay focused and have a clear plan for the brand and marketing262827.

Regulatory Landscape and Government Policies

Tesla works in a complex world of rules and support for electric cars and clean energy29. These rules affect how the company does business. Tesla uses government help and rewards to grow and achieve its goals.

Tesla and Environmental Regulations

Tesla makes a lot of electric cars and must follow strict green rules29. The company makes sure its cars are good for the planet. This has led to many approvals and rewards for Tesla.

Government Incentives for Tesla Vehicles

- Charge Ready NY 2.0 gives $4,000 per charging port at public spots in poor areas29.

- Workplaces and homes get $2,000 per port for charging setups29.

- An extra $500 per port is given for charging gear at workplaces or homes in poor areas29.

- Charging spots for cars or fleets get $1,000 per port29.

- Level 2 chargers give cars up to 25 miles of range per hour of charge29.

- Big workplaces and homes get more rewards for charging setups29.

- Charge Ready NY 2.0 rebates can be mixed with New York State tax breaks for charging stations29.

- Owners of charging gear might get Federal tax credits29.

These rewards and rules help make Tesla’s electric cars more popular, especially in poor areas2916.

| Manufacturer | Market Share |

|---|---|

| Tesla | 14.55% |

| Volkswagen Group | 12.52% |

Tesla is the top maker of electric cars and has a big impact on the market16. Its focus on being green and innovative has gotten it support and rewards. This has helped Tesla grow and stay competitive2916.

Conclusion

Tesla’s stock and future are drawing a lot of attention from investors and the market. The company is a leader in the automotive and energy fields thanks to its diversification, tech innovations, and focus on sustainability30. With a market cap of $802.147 billion and revenue of $96.773 billion, Tesla is a major player30.

Despite facing challenges like more competition and rules, Tesla stands out with its strong brand, forward-thinking leadership, and growth chances31. Its stock price has hit a high since January, going up over 6% on Monday. The company’s 52-week high of $299.29 is 19% above today’s price3031.

For investors eyeing Tesla’s future, the company’s financials look strong. It has a profit margin of 14.37%, a return on equity of 23.74%, and a price-to-sales ratio of 9.262. But, its forward P/E ratio of 101.01 and PEG ratio of 4.56 show the market’s high hopes for Tesla’s growth and innovation2. As Tesla keeps pushing the electric vehicle revolution and expands into new areas, its stock is an intriguing, yet complex, choice for investors.

FAQ

What has been the recent performance of Tesla’s stock?

Tesla’s stock price has gone up by 26.04% in the past week and 43.44% over the last month. The highest stock price was 4.50 on November 4, 2021. The lowest was

FAQ

What has been the recent performance of Tesla’s stock?

Tesla’s stock price has gone up by 26.04% in the past week and 43.44% over the last month. The highest stock price was $414.50 on November 4, 2021. The lowest was $1.00 on July 7, 2010.

What is Tesla’s current market capitalization?

Tesla’s market capitalization is currently $785.79 billion.

What are the price targets for Tesla’s stock?

Analysts predict Tesla’s stock could go as high as $310.00 or as low as $85.00.

What are Tesla’s plans beyond electric vehicles?

Tesla is looking into making humanoid robots like the TARS robot from Interstellar. They also plan to introduce a robotaxi service.

What are the current analyst ratings and price targets for Tesla’s stock?

Analysts rate Tesla stock as a “Hold”. They have a price target of $184.41, which is 26.68% lower than now.

What are the key financial metrics for Tesla’s recent performance?

Tesla made $21.30 billion in revenue last quarter. Next quarter, they expect $24.04 billion. The net income was $1.17 billion, down 85.23% from before.

The EBITDA is $12.27 billion, with a 14.01% margin. EPS was $0.45, an 8.54% surprise.

What challenges has Tesla faced that have impacted its stock price?

Tesla faced issues with demand and production. They cut prices and production. There were also losses in China and Europe.

Competition in the electric vehicle market is growing too.

What are the opportunities and risks involved in investing in Tesla’s stock?

Investing in Tesla stock has both upsides and downsides. The company’s innovative products and growth potential are attractive. But, it also faces production challenges, regulatory changes, and more competition.

How has Tesla’s stock performance and trends been analyzed?

Tesla’s stock has a beta of 2.14, showing it’s quite volatile. It hit an all-time high of $414.50 on November 4, 2021, and a low of $1.00 on July 7, 2010.

How has Tesla impacted the automotive industry?

Tesla has changed the automotive industry with its electric vehicles and technology. It’s leading the shift to electric and sustainable mobility. This has pushed traditional car makers to focus more on EVs too.

What is Tesla’s commitment to sustainability and environmental responsibility?

Tesla is all about sustainability and environmental responsibility. They use renewable energy in their operations and offer energy storage solutions to consumers and businesses.

How has Tesla’s brand and marketing strategies contributed to its success?

Tesla has built a strong brand thanks to Elon Musk and its innovative products. They connect directly with customers through social media and their retail stores.

How has the regulatory environment impacted Tesla’s business?

Tesla deals with a complex set of regulations. These include rules on emissions, electric vehicle adoption, and renewable energy. Tesla has used government support and incentives to grow and achieve its goals.

.00 on July 7, 2010.

What is Tesla’s current market capitalization?

Tesla’s market capitalization is currently 5.79 billion.

What are the price targets for Tesla’s stock?

Analysts predict Tesla’s stock could go as high as 0.00 or as low as .00.

What are Tesla’s plans beyond electric vehicles?

Tesla is looking into making humanoid robots like the TARS robot from Interstellar. They also plan to introduce a robotaxi service.

What are the current analyst ratings and price targets for Tesla’s stock?

Analysts rate Tesla stock as a “Hold”. They have a price target of 4.41, which is 26.68% lower than now.

What are the key financial metrics for Tesla’s recent performance?

Tesla made .30 billion in revenue last quarter. Next quarter, they expect .04 billion. The net income was

FAQ

What has been the recent performance of Tesla’s stock?

Tesla’s stock price has gone up by 26.04% in the past week and 43.44% over the last month. The highest stock price was $414.50 on November 4, 2021. The lowest was $1.00 on July 7, 2010.

What is Tesla’s current market capitalization?

Tesla’s market capitalization is currently $785.79 billion.

What are the price targets for Tesla’s stock?

Analysts predict Tesla’s stock could go as high as $310.00 or as low as $85.00.

What are Tesla’s plans beyond electric vehicles?

Tesla is looking into making humanoid robots like the TARS robot from Interstellar. They also plan to introduce a robotaxi service.

What are the current analyst ratings and price targets for Tesla’s stock?

Analysts rate Tesla stock as a “Hold”. They have a price target of $184.41, which is 26.68% lower than now.

What are the key financial metrics for Tesla’s recent performance?

Tesla made $21.30 billion in revenue last quarter. Next quarter, they expect $24.04 billion. The net income was $1.17 billion, down 85.23% from before.

The EBITDA is $12.27 billion, with a 14.01% margin. EPS was $0.45, an 8.54% surprise.

What challenges has Tesla faced that have impacted its stock price?

Tesla faced issues with demand and production. They cut prices and production. There were also losses in China and Europe.

Competition in the electric vehicle market is growing too.

What are the opportunities and risks involved in investing in Tesla’s stock?

Investing in Tesla stock has both upsides and downsides. The company’s innovative products and growth potential are attractive. But, it also faces production challenges, regulatory changes, and more competition.

How has Tesla’s stock performance and trends been analyzed?

Tesla’s stock has a beta of 2.14, showing it’s quite volatile. It hit an all-time high of $414.50 on November 4, 2021, and a low of $1.00 on July 7, 2010.

How has Tesla impacted the automotive industry?

Tesla has changed the automotive industry with its electric vehicles and technology. It’s leading the shift to electric and sustainable mobility. This has pushed traditional car makers to focus more on EVs too.

What is Tesla’s commitment to sustainability and environmental responsibility?

Tesla is all about sustainability and environmental responsibility. They use renewable energy in their operations and offer energy storage solutions to consumers and businesses.

How has Tesla’s brand and marketing strategies contributed to its success?

Tesla has built a strong brand thanks to Elon Musk and its innovative products. They connect directly with customers through social media and their retail stores.

How has the regulatory environment impacted Tesla’s business?

Tesla deals with a complex set of regulations. These include rules on emissions, electric vehicle adoption, and renewable energy. Tesla has used government support and incentives to grow and achieve its goals.

.17 billion, down 85.23% from before.

The EBITDA is .27 billion, with a 14.01% margin. EPS was

FAQ

What has been the recent performance of Tesla’s stock?

Tesla’s stock price has gone up by 26.04% in the past week and 43.44% over the last month. The highest stock price was $414.50 on November 4, 2021. The lowest was $1.00 on July 7, 2010.

What is Tesla’s current market capitalization?

Tesla’s market capitalization is currently $785.79 billion.

What are the price targets for Tesla’s stock?

Analysts predict Tesla’s stock could go as high as $310.00 or as low as $85.00.

What are Tesla’s plans beyond electric vehicles?

Tesla is looking into making humanoid robots like the TARS robot from Interstellar. They also plan to introduce a robotaxi service.

What are the current analyst ratings and price targets for Tesla’s stock?

Analysts rate Tesla stock as a “Hold”. They have a price target of $184.41, which is 26.68% lower than now.

What are the key financial metrics for Tesla’s recent performance?

Tesla made $21.30 billion in revenue last quarter. Next quarter, they expect $24.04 billion. The net income was $1.17 billion, down 85.23% from before.

The EBITDA is $12.27 billion, with a 14.01% margin. EPS was $0.45, an 8.54% surprise.

What challenges has Tesla faced that have impacted its stock price?

Tesla faced issues with demand and production. They cut prices and production. There were also losses in China and Europe.

Competition in the electric vehicle market is growing too.

What are the opportunities and risks involved in investing in Tesla’s stock?

Investing in Tesla stock has both upsides and downsides. The company’s innovative products and growth potential are attractive. But, it also faces production challenges, regulatory changes, and more competition.

How has Tesla’s stock performance and trends been analyzed?

Tesla’s stock has a beta of 2.14, showing it’s quite volatile. It hit an all-time high of $414.50 on November 4, 2021, and a low of $1.00 on July 7, 2010.

How has Tesla impacted the automotive industry?

Tesla has changed the automotive industry with its electric vehicles and technology. It’s leading the shift to electric and sustainable mobility. This has pushed traditional car makers to focus more on EVs too.

What is Tesla’s commitment to sustainability and environmental responsibility?

Tesla is all about sustainability and environmental responsibility. They use renewable energy in their operations and offer energy storage solutions to consumers and businesses.

How has Tesla’s brand and marketing strategies contributed to its success?

Tesla has built a strong brand thanks to Elon Musk and its innovative products. They connect directly with customers through social media and their retail stores.

How has the regulatory environment impacted Tesla’s business?

Tesla deals with a complex set of regulations. These include rules on emissions, electric vehicle adoption, and renewable energy. Tesla has used government support and incentives to grow and achieve its goals.

.45, an 8.54% surprise.

What challenges has Tesla faced that have impacted its stock price?

Tesla faced issues with demand and production. They cut prices and production. There were also losses in China and Europe.

Competition in the electric vehicle market is growing too.

What are the opportunities and risks involved in investing in Tesla’s stock?

Investing in Tesla stock has both upsides and downsides. The company’s innovative products and growth potential are attractive. But, it also faces production challenges, regulatory changes, and more competition.

How has Tesla’s stock performance and trends been analyzed?

Tesla’s stock has a beta of 2.14, showing it’s quite volatile. It hit an all-time high of 4.50 on November 4, 2021, and a low of

FAQ

What has been the recent performance of Tesla’s stock?

Tesla’s stock price has gone up by 26.04% in the past week and 43.44% over the last month. The highest stock price was $414.50 on November 4, 2021. The lowest was $1.00 on July 7, 2010.

What is Tesla’s current market capitalization?

Tesla’s market capitalization is currently $785.79 billion.

What are the price targets for Tesla’s stock?

Analysts predict Tesla’s stock could go as high as $310.00 or as low as $85.00.

What are Tesla’s plans beyond electric vehicles?

Tesla is looking into making humanoid robots like the TARS robot from Interstellar. They also plan to introduce a robotaxi service.

What are the current analyst ratings and price targets for Tesla’s stock?

Analysts rate Tesla stock as a “Hold”. They have a price target of $184.41, which is 26.68% lower than now.

What are the key financial metrics for Tesla’s recent performance?

Tesla made $21.30 billion in revenue last quarter. Next quarter, they expect $24.04 billion. The net income was $1.17 billion, down 85.23% from before.

The EBITDA is $12.27 billion, with a 14.01% margin. EPS was $0.45, an 8.54% surprise.

What challenges has Tesla faced that have impacted its stock price?

Tesla faced issues with demand and production. They cut prices and production. There were also losses in China and Europe.

Competition in the electric vehicle market is growing too.

What are the opportunities and risks involved in investing in Tesla’s stock?

Investing in Tesla stock has both upsides and downsides. The company’s innovative products and growth potential are attractive. But, it also faces production challenges, regulatory changes, and more competition.

How has Tesla’s stock performance and trends been analyzed?

Tesla’s stock has a beta of 2.14, showing it’s quite volatile. It hit an all-time high of $414.50 on November 4, 2021, and a low of $1.00 on July 7, 2010.

How has Tesla impacted the automotive industry?

Tesla has changed the automotive industry with its electric vehicles and technology. It’s leading the shift to electric and sustainable mobility. This has pushed traditional car makers to focus more on EVs too.

What is Tesla’s commitment to sustainability and environmental responsibility?

Tesla is all about sustainability and environmental responsibility. They use renewable energy in their operations and offer energy storage solutions to consumers and businesses.

How has Tesla’s brand and marketing strategies contributed to its success?

Tesla has built a strong brand thanks to Elon Musk and its innovative products. They connect directly with customers through social media and their retail stores.

How has the regulatory environment impacted Tesla’s business?

Tesla deals with a complex set of regulations. These include rules on emissions, electric vehicle adoption, and renewable energy. Tesla has used government support and incentives to grow and achieve its goals.

.00 on July 7, 2010.

How has Tesla impacted the automotive industry?

Tesla has changed the automotive industry with its electric vehicles and technology. It’s leading the shift to electric and sustainable mobility. This has pushed traditional car makers to focus more on EVs too.

What is Tesla’s commitment to sustainability and environmental responsibility?

Tesla is all about sustainability and environmental responsibility. They use renewable energy in their operations and offer energy storage solutions to consumers and businesses.

How has Tesla’s brand and marketing strategies contributed to its success?

Tesla has built a strong brand thanks to Elon Musk and its innovative products. They connect directly with customers through social media and their retail stores.

How has the regulatory environment impacted Tesla’s business?

Tesla deals with a complex set of regulations. These include rules on emissions, electric vehicle adoption, and renewable energy. Tesla has used government support and incentives to grow and achieve its goals.

Source Links

- Tesla (Nasdaq:TSLA) – Stock Price, News & Analysis – Simply Wall St – https://simplywall.st/stocks/us/automobiles/nasdaq-tsla/tesla

- Tesla, Inc. (TSLA) Stock Price, News, Quote & History – Yahoo Finance – https://finance.yahoo.com/quote/TSLA/

- Tesla stock forecast and price prediction – https://www.usatoday.com/money/blueprint/investing/stock-forecast-tesla/

- TSLA Stock Price — Tesla Chart — TradingView – https://www.tradingview.com/symbols/NASDAQ-TSLA/

- Tesla, Inc. (TSLA) Stock Historical Prices & Data – Yahoo Finance – https://finance.yahoo.com/quote/TSLA/history/

- Tesla (TSLA) Stock Forecast & Price Prediction 2025, 2030 | CoinCodex – https://coincodex.com/stock/TSLA/price-prediction/

- Tesla Inc (TSLA) – https://www.morningstar.com/stocks/xnas/tsla/quote

- Tesla, Inc. (TSLA) Valuation Measures & Financial Statistics – https://finance.yahoo.com/quote/TSLA/key-statistics/

- Tesla Inc (NASDAQ:TSLA) – https://www.alphaspread.com/security/nasdaq/tsla/summary

- What is the current Price Target and Forecast for Tesla (TSLA) – https://www.zacks.com/stock/research/TSLA/price-target-stock-forecast

- Tesla (TSLA) Stock Forecast and Price Target 2024 – https://www.marketbeat.com/stocks/NASDAQ/TSLA/forecast/

- Why Tesla’s Stock Price Is Surging – Here’s What Elon Musk Said | Bankrate – https://www.bankrate.com/investing/tesla-stock-price-surge-earnings-affordable-ev/

- Tesla Stock Price Guide: What Drives Tesla’s Share Price? – https://www.plus500.com/en/instruments/tsla/what-drives-tesla-share-price~2

- Tesla stock rises again after better-than-expected deliveries report – https://www.cnbc.com/2024/07/03/tesla-tsla-shares-rally-after-better-than-expected-deliveries-report.html

- Tesla Is Hitting New Highs By This Metric – https://www.investors.com/news/tesla-stock-is-plunging-not-cheaper-by-earnings-metric/

- 6 Big Risks of Investing in Tesla Stock – https://www.investopedia.com/articles/markets/102815/biggest-risks-investing-tesla-stock.asp

- How to Buy Tesla Stock (TSLA) | The Motley Fool – https://www.fool.com/investing/how-to-invest/stocks/how-to-invest-in-tesla-stock/

- Is Tesla Stock A Buy Or A Sell With Elon Musk’s Pay Package Expected To Pass By ‘Wide Margins’? – https://www.investors.com/news/tesla-stock-a-buy-or-a-sell-in-2024/

- Technical Analysis of Tesla (NASDAQ:TSLA) — TradingView – https://www.tradingview.com/symbols/NASDAQ-TSLA/technicals/

- Tesla, Inc. (TSLA) Advanced Charting – https://www.nasdaq.com/market-activity/stocks/tsla/advanced-charting

- Tesla’s stock surges on optimism for Musk’s affordable car line-up – https://www.euronews.com/business/2024/04/24/teslas-stock-surges-on-optimism-for-musks-affordable-car-line-up

- Tesla has transformed the car industry — but its biggest strength could become its greatest liability – https://www.businessinsider.com/teslas-influence-on-the-auto-industry-2018-2

- Tesla’s ‘gravity-defying’ powers at risk as electric vehicle market slows – https://www.ft.com/content/fc0e7bbc-940c-496a-bb97-14f3b2f6ca57

- Tulipshare | Impact investor and shareholder advocacy group – https://tulipshare.com/engagements/tsla-2024

- Tesla Accelerates the Transition to Sustainable Energy – https://harbert.auburn.edu/binaries/documents/center-for-ethical-organizational-cultures/cases/tesla.pdf

- Tesla Marketing Strategy 2024: A Case Study | Simplilearn – https://www.simplilearn.com/tutorials/marketing-case-studies-tutorial/tesla-marketing-strategy

- Does Tesla’s $0 Marketing Strategy Actually Work? – https://segmentify.com/blog/tesla-marketing-strategy/

- Tesla’s Unconventional Marketing Ethos – ClickZ – https://www.clickz.com/teslas-unconventional-marketing-ethos/

- Charge Ready NY 2.0 – NYSERDA – https://www.nyserda.ny.gov/All-Programs/Charge-Ready-NY

- Tesla – 14 Year Stock Price History | TSLA – https://www.macrotrends.net/stocks/charts/TSLA/tesla/stock-price-history

- Watch These Tesla Stock Price Levels as EV Maker Releases Delivery Numbers – https://www.investopedia.com/watch-these-tesla-stock-price-levels-as-ev-maker-releases-delivery-numbers-8672479